This guide provides the steps to calculate prompt pay interest and manually post the interest item(s) to FAMIS.

The State of Texas prompt payment law requires vendors to be paid within 30 days of receiving the goods or services they provide. If payment is not received within this timeframe, an interest penalty (prompt pay interest) is imposed. The penalty amount is calculated daily until the vendor receives the payment.

To comply with this legislation, FAMIS calculates and posts interest when warranted. For state accounts, FAMIS sends the request for payment to the state, which makes its own calculation and includes any interest in the payment to the vendor. FAMIS receives a file back from the State that is posted to update the FAMIS accounts with the applicable interest charges.

When an interest item fails to post, corrections must be made to get the interest items posted. Once the problem has been fixed, the items will be posted during the next nightly batch process. Items can also be posted manually.

Calculating Prompt Pay Interest

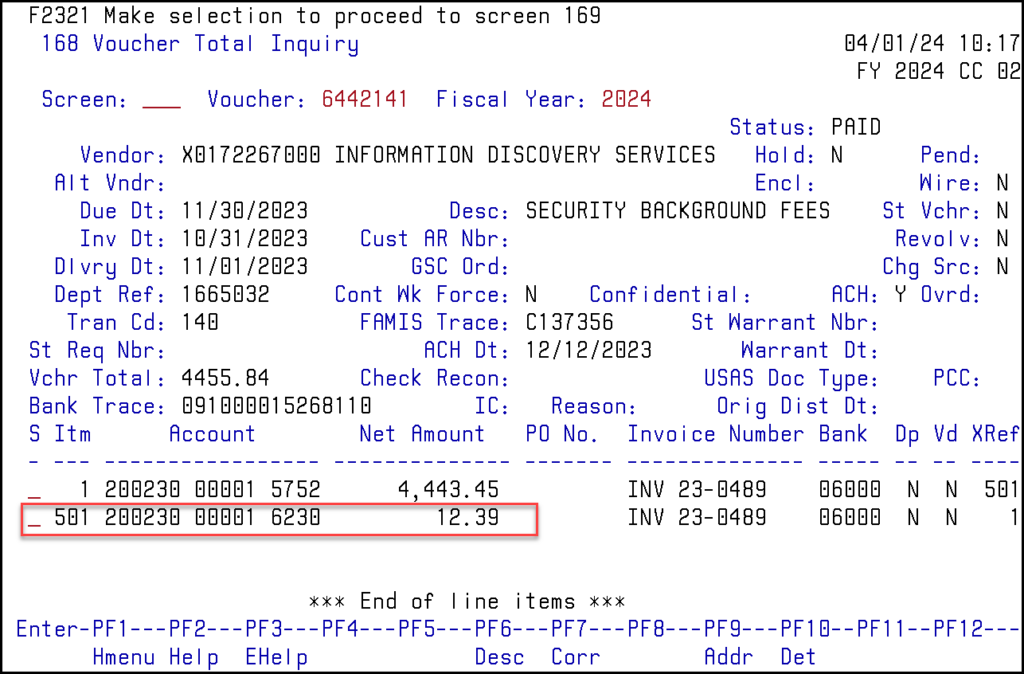

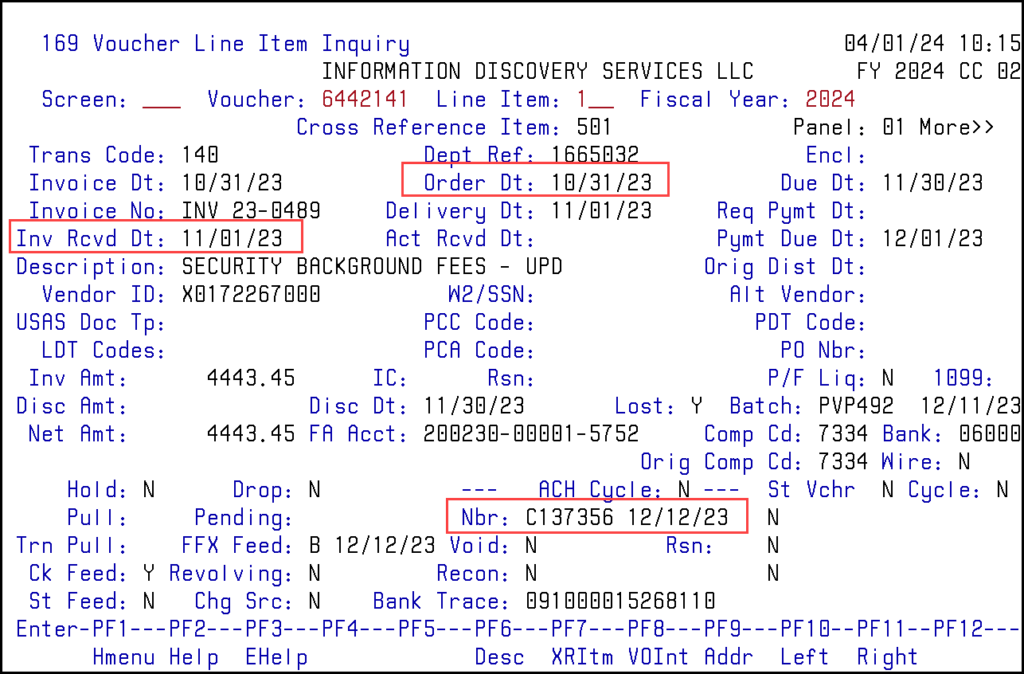

- Access the voucher information on Screens 168 and 169.

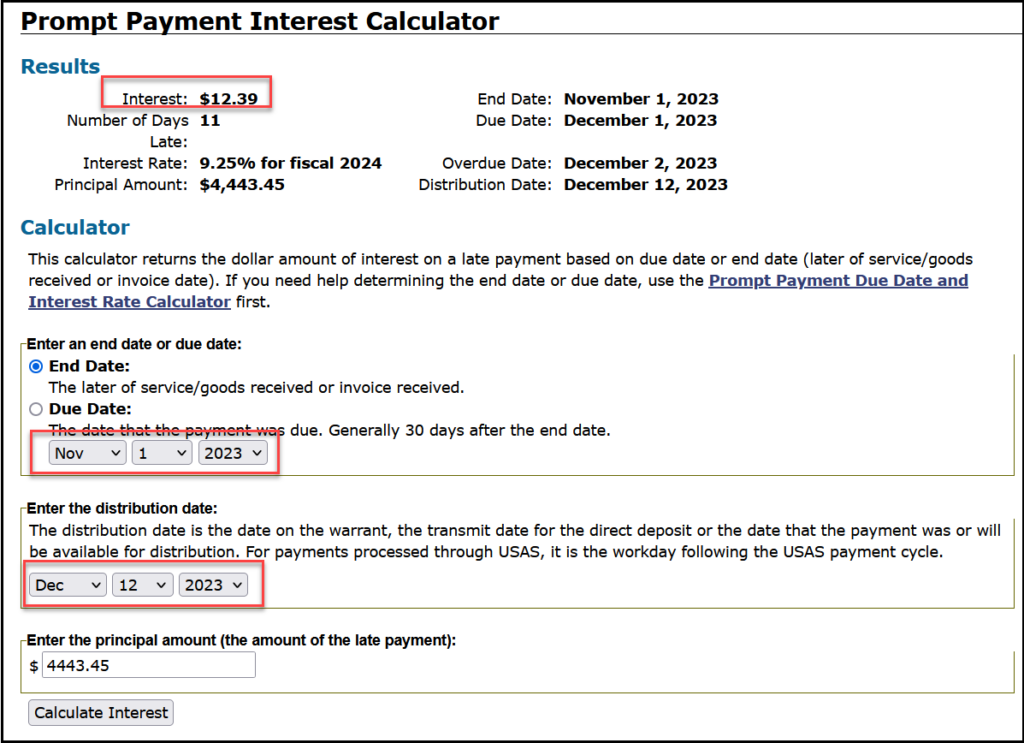

- Calculate the prompt pay interest for each line item using the Prompt Payment Interest Calculator on the Comptroller’s website (https://fmx.cpa.texas.gov/fm/usas/prompay/ppicalc.php).

Posting Interest Manually

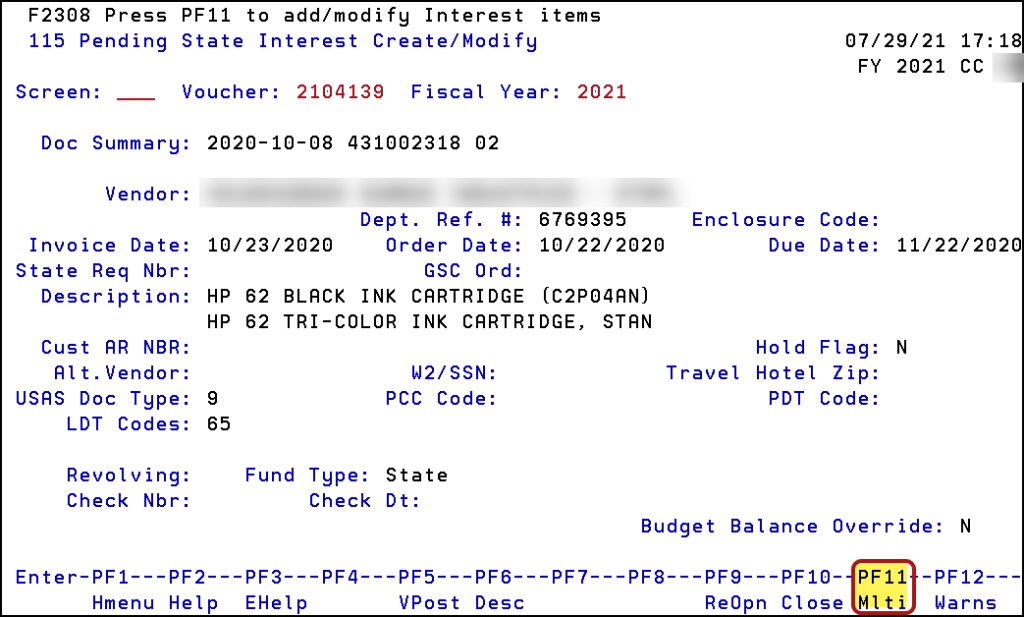

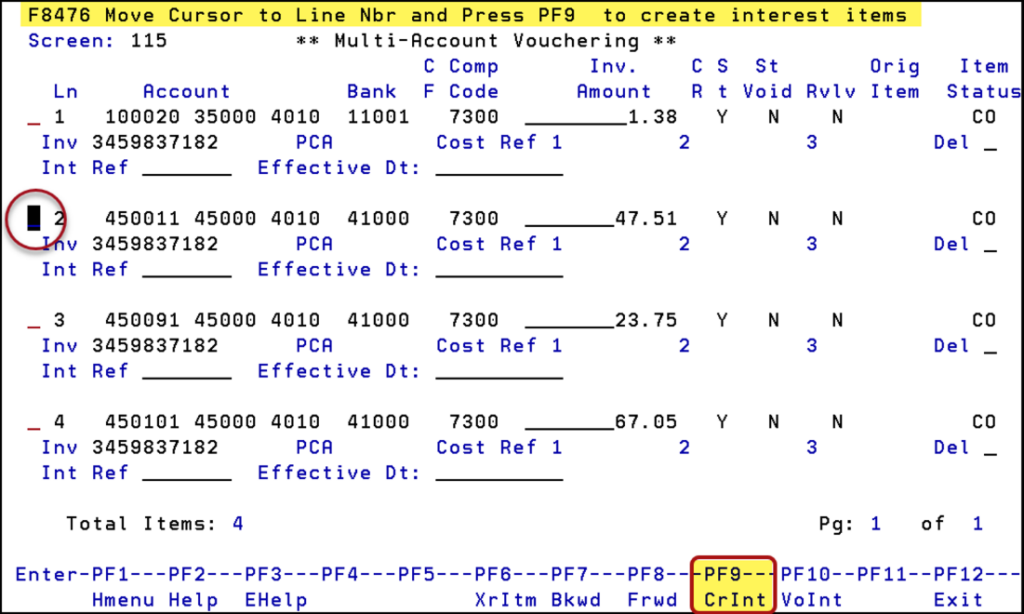

- Navigate to Screen 115 (Pending State Interest (Create/Modify).

- Input the first voucher number and press Enter.

- Press F11 to move to the Multi-Account Vouchering screen.

- Tab to the desired line and press F9 to add an interest line.

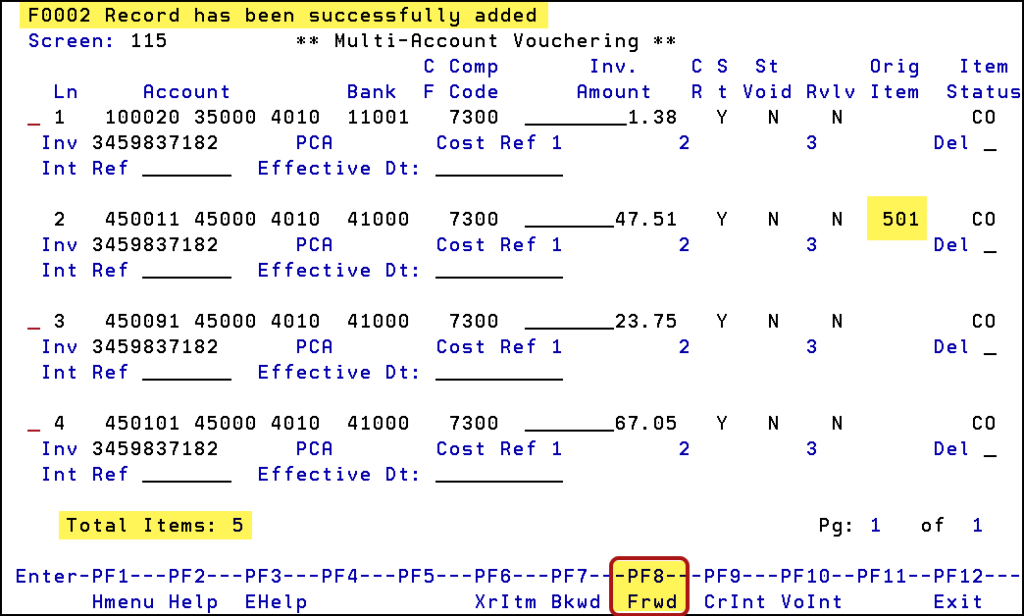

A confirmation message, “Record has been successfully added,” will appear.

Repeat Step 4 to add additional interest line items as necessary.

- When all interest line items are added, press F8 to page forward.

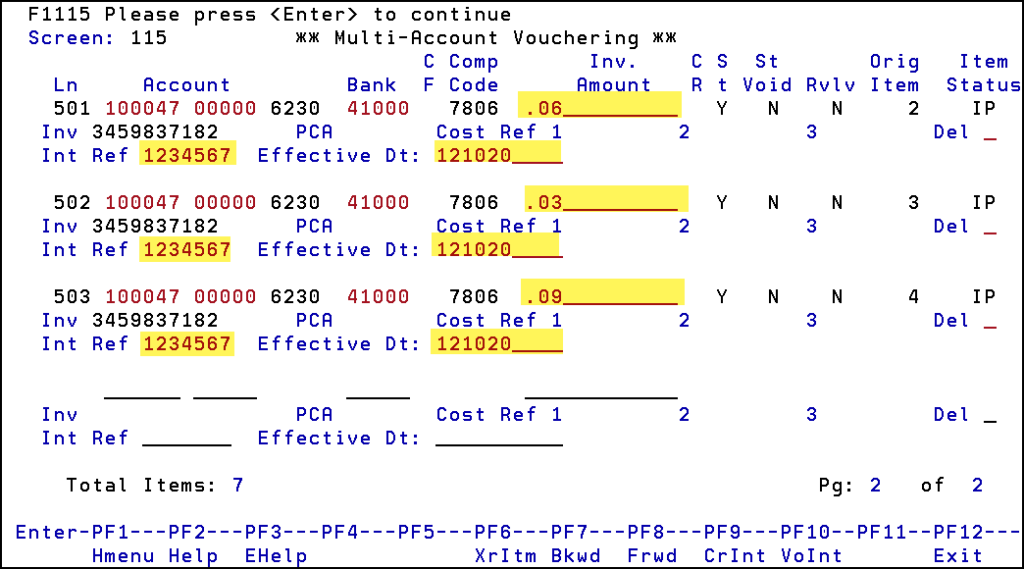

- Enter the interest amount, a seven-digit reference number and an effective date for each line.

- Confirm the entries by pressing Enter. A message, “Record has been successfully modified,” will indicate the successful modification of the record.

- Press F12 to exit and F10 to close the session.