This guide provides information on using the account summary screens in FAMIS for General Ledger (GL), Subsidiary Ledger (SL) and Support Accounts (SA). The guide describes how to read the screens and interpret the figures displayed on the screens.

Subsidiary Ledger Accounts

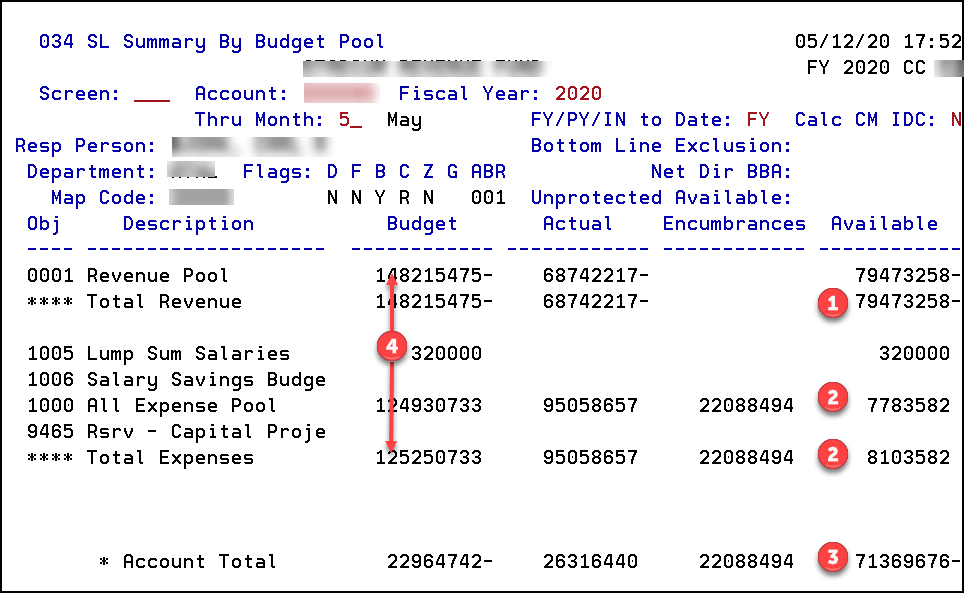

Screen 34 (SL Summary By Budget Pool) can be used for Subsidiary Ledger (SL) accounts. SL accounts always begin with non-zero numbers (e.g., 123456) and are six digits in length. The balance of the SL account shows the available amounts to be collected in revenue or to be spent for expenses in relation to the budget. If the account has support accounts (SAs), then the balance on Screen 34 includes the sum of all of the SAs.

034 SL Summary By Budget Pool

034 SL Summary By Budget Pool 05/12/20 17:52

SL ACCOUNT NAME FY 2020 CC nn

Screen: ___ Account: 3xxxxxx Fiscal Year: 2020

Thru Month: 5_ May FY/PY/IN to Date: FY Calc CM IDC: N

Resp Person: USER, BETTER Bottom Line Exclusion:

Department: DEPT Flags: D F B C Z G ABR Net Dir BBA:

Map Code: 3xxxx N N Y R N 001 Unprotected Available:

Obj Description Budget Actual Encumbrances Available

---- -------------------- ------------ ------------ ------------ ------------

0001 Revenue Pool 148215475- 68742217- 79473258-

**** Total Revenue 148215475- 68742217- 79473258-

1005 Lump Sum Salaries 320000 320000

1006 Salary Savings Budge

1000 All Expense Pool 124930733 95058657 22088494 8103582

9465 Rsrv - Capital Proje

**** Total Expenses 125250733 95103785 22088494 8103582

* Account Total 22964742- 26361440 22088494 71369676-

Enter-PF1---PF2---PF3---PF4---PF5---PF6---PF7---PF8---PF9---PF10--PF11--PF12---

Hmenu Help EHelp Left Right

In this example:

- This account still needs to collect $79,473,258.00 in revenue for this fiscal year. Since revenue is a credit in accounting terms, the entry appears in FAMIS as a signed entry.

- This account has $320,000.00 available to spend in Lump Sum Salaries and $7,783,582.00 available to spend for all other expenses.

The calculation is (Budget − Actual − Encumbrances = Available amount to spend). - The balance available on the Account Total line, $71,369,676.00, represents the net of uncollected revenue less the total expense budget.

- All budget entries are included in the Budget column: Budget Brought Forward, New Budget, Budget Adjustments and Budget Transfers (including Departmental Budget Requests [DBRs]).

The default for this screen displays a rounded number. Pressing the F11 key will change the display to show non-rounded numbers. Pressing the F10 key will return the display to rounded numbers.

Support Accounts

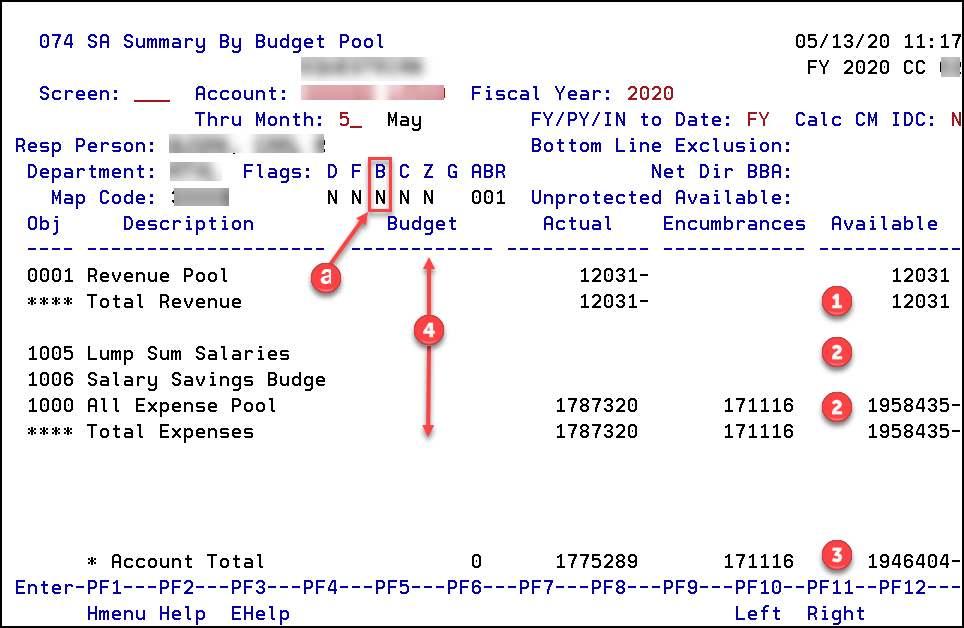

Screen 74 (SA Summary by Budget Pool) can be used for SAs. SAs are a subset of an SL account and are five digits in length. Since SAs are a subset of an SL account, they are always displayed with the SL account (e.g. 123456-12345). An SA may be one of many linked to an SL account. The balance of the SA shows the available amounts to be collected in revenue or to be spent for expenses in relation to the budget.

074 SA Summary By Budget Pool

074 SA Summary By Budget Pool 05/13/20 11:17

SA ACCOUNT NAME FY 2020 CC nn

Screen: ___ Account: 3xxxxx 14500 Fiscal Year: 2020

Thru Month: 5_ May FY/PY/IN to Date: FY Calc CM IDC: N

Resp Person: USER, BETTER Bottom Line Exclusion:

Department: DEPT Flags: D F B C Z G ABR Net Dir BBA:

Map Code: 3xxxx N N N N N 001 Unprotected Available:

Obj Description Budget Actual Encumbrances Available

---- -------------------- ------------ ------------ ------------ ------------

0001 Revenue Pool 12031- 12031

**** Total Revenue 12031- 12031

1005 Lump Sum Salaries

1006 Salary Savings Budge

1000 All Expense Pool 1787320 171116 1958435-

**** Total Expenses 1787320 171116 1958435-

* Account Total 0 1775289 171116 1946404-

Enter-PF1---PF2---PF3---PF4---PF5---PF6---PF7---PF8---PF9---PF10--PF11--PF12---

Hmenu Help EHelp Left Right

In this example:

- This account still needs to collect $12,031.00 in revenue for this fiscal year. Since revenue is a credit in accounting terms, the entry appears in FAMIS as a signed entry.

- This account as no budget available to spend in Lump Sum Salaries and has an overspent budget of $1,958,435.00 for all other expenses. This SA has the bottom-line budget checking turned off (a), allowing all of the SAs to spend based on the parent SL budget. This means that the SAs can run a negative budget as long as the SL budget remains positive.

The calculation is (Budget − Actual − Encumbrances = Available amount to spend). - The balance available on the Account Total line, $1,946,404.00, represents the net of uncollected revenue less the total expense budget.

- All budget entries are included in the budget column: Budget Brought Forward, New Budget, Budget Adjustments and Budget Transfers (including DBRs).

The default for this screen displays a rounded number. Pressing the F11 key will change the display to show non-rounded numbers. Pressing the F10 key will return the display to rounded numbers.

General Ledger Accounts: Balance Sheet

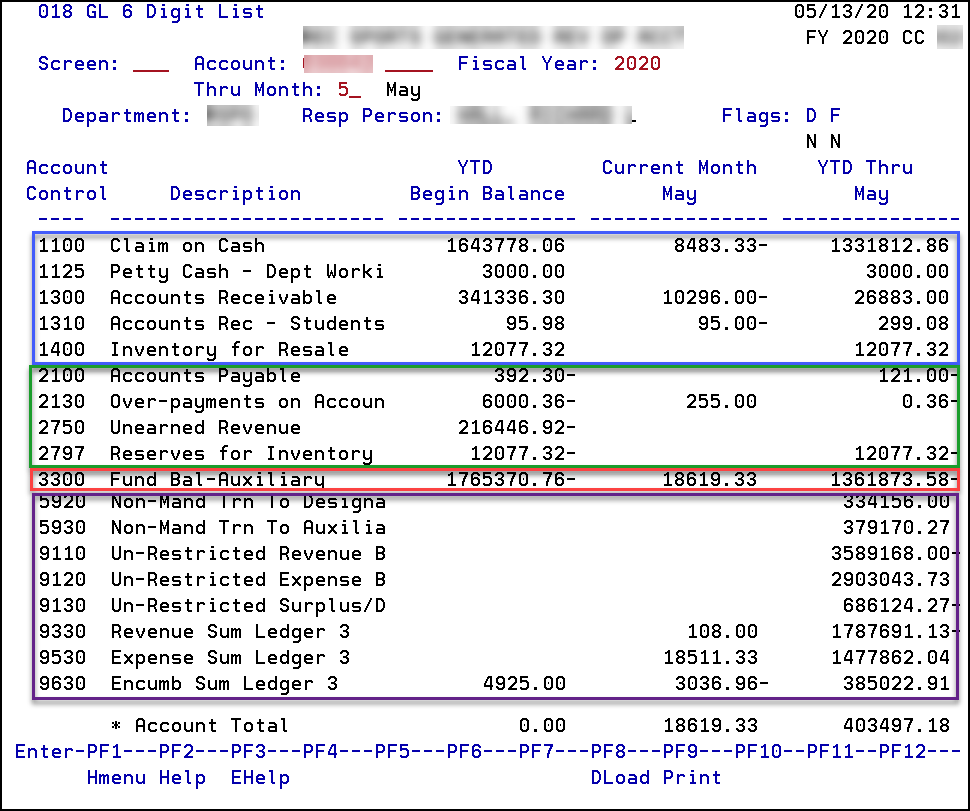

General Ledger (GL) accounts always begin with a zero (e.g. 023456) and are six digits in length. Using Screen 18 (GL 6 Digit List), a balance sheet display of the account is available. GL account controls represent balance sheet items.

018 GL 6 Digit List

018 GL 6 Digit List 05/13/20 15:50

GL ACCOUNT NAME FY 2020 CC nn

Screen: ___ Account: 0xxxxx ____ Fiscal Year: 2020

Thru Month: 5_ May

Department: DEPT Resp Person: USER, BETTER Flags: D F

N N

Account YTD Current Month YTD Thru

Control Description Begin Balance May May

---- ----------------------- --------------- --------------- ---------------

1100 Claim on Cash 1643778.06 8483.33- 1331812.86

1125 Petty Cash - Dept Worki 3000.00 3000.00

1300 Accounts Receivable 341336.30 10296.00- 26883.00

1310 Accounts Rec - Students 95.98 95.00- 299.08

1400 Inventory for Resale 12077.32 12077.32

2100 Accounts Payable 392.30- 121.00-

2130 Over-payments on Accoun 6000.36- 255.00 0.36-

2750 Unearned Revenue 216446.92-

2797 Reserves for Inventory 12077.32- 12077.32-

3300 Fund Bal-Auxiliary 1765370.76- 18619.33 1361873.58-

5920 Non-Mand Trn To Designa 334156.00

5930 Non-Mand Trn To Auxilia 379170.27

9110 Un-Restricted Revenue B 3589168.00-

9120 Un-Restricted Expense B 2903043.73

9130 Un-Restricted Surplus/D 686124.27-

9330 Revenue Sum Ledger 3 108.00 1787691.13-

9530 Expense Sum Ledger 3 18511.33 1477862.04

9630 Encumb Sum Ledger 3 4925.00 3036.96- 385022.91

* Account Total 0.00 18619.33 403497.18

Enter-PF1---PF2---PF3---PF4---PF5---PF6---PF7---PF8---PF9---PF10--PF11--PF12---

Hmenu Help EHelp DLoad Print

In this example:

- Account controls 1100 through 1999 are assets. Assets are debit entries in accounting, so in FAMIS positive balances for these are displayed as unsigned.

- Account controls 2000 through 2999 are liabilities.

- Account controls 3000 through 3940 are fund balances. Liabilities and fund balances are credit entries in accounting, so in FAMIS positive balances for these are displayed as signed.

- Account controls 4000 through 9999 are accumulators that affect fund balance but are not a true part of the balance sheet.

- The sum of the assets ($1,374,072.26) less the sum of the liabilities ($12,198.68) equals the fund balance ($1,361,873.58).

General Ledger Accounts: Reserve Balance

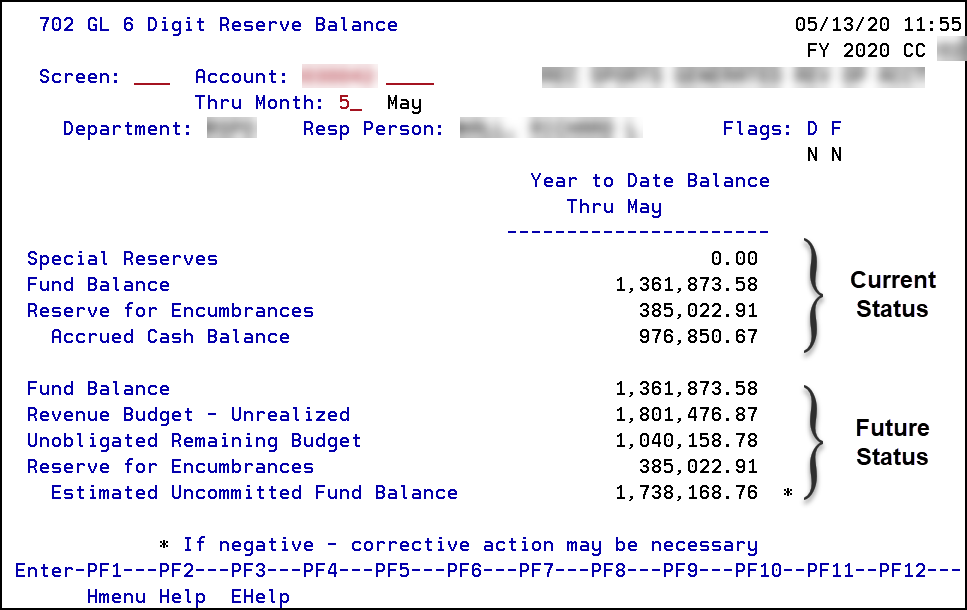

In addition to using Screen 18 to see the balance sheet for a GL account, Screen 702 (GL 6 Digit Reserve Balance)allows users to see both the current status of the GL account (and the sum of all the SL accounts mapped to the GL account) as well as the future status.

702 GL 6 Digit Reserve Balance

702 GL 6 Digit Reserve Balance 05/13/20 16:17

FY 2020 CC nn

Screen: ___ Account: 03xxxx ____ GL ACCOUNT NAME

Thru Month: 5_ May

Department: DEPT Resp Person: USER, BETTER Flags: D F

N N

Year to Date Balance

Thru May

----------------------

Special Reserves 0.00

Fund Balance 1,361,873.58

Reserve for Encumbrances 385,022.91

Accrued Cash Balance 976,850.67

Fund Balance 1,361,873.58

Revenue Budget - Unrealized 1,801,476.87

Unobligated Remaining Budget 1,040,158.78

Reserve for Encumbrances 385,022.91

Estimated Uncommitted Fund Balance 1,738,168.76 *

* If negative - corrective action may be necessary

Enter-PF1---PF2---PF3---PF4---PF5---PF6---PF7---PF8---PF9---PF10--PF11--PF12---

Hmenu Help EHelp

Current Status

The top half of the screen shows the current status of a GL account. In the display above, this GL account has $1,361,873.58 in fund balance, or “true cash,” and $385,022.91 committed in encumbrances. If an encumbrance is reduced, the commitment is released and added back to the accrued cash balance. The accrued cash, or fund balance less encumbrances, is equal to $976,850.67.

Future Status

The bottom half of the screen is a management tool showing the future status or what the account would look like if all of the budgeted revenue is collected and all of the budgeted expenses are expended for the fiscal year. If this were to happen, at the end of the year this account would have $1,738,168.76 available to roll forward to the next fiscal year.

Finding Negative Account Balances

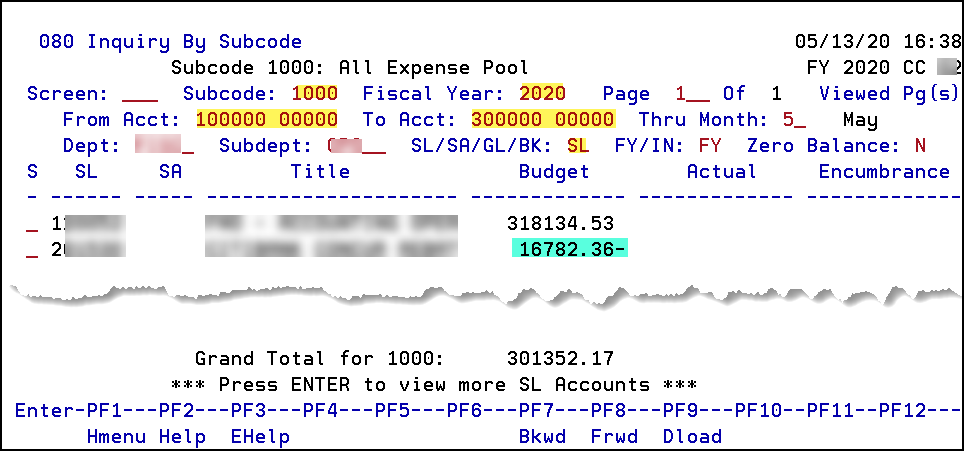

To quickly identify accounts in the department with negative balances, use Screen 80 (Inquiry by Subcode).

080 Inquiry By Subcode

080 Inquiry By Subcode 05/13/20 16:38

Subcode 1000: All Expense Pool FY 2020 CC nn

Screen: ___ Subcode: 1000 Fiscal Year: 2020 Page 1__ Of 1 Viewed Pg(s)

From Acct: 100000 00000 To Acct: 300000 00000 Thru Month: 5_ May

Dept: DEPT_ Subdept: _____ SL/SA/GL/BK: SL FY/IN: FY Zero Balance: N

S SL SA Title Budget Actual Encumbrance

- ------ ----- --------------------- ------------- ------------- -------------

_ 1xxxxx ACCOUNT 1 NAME 318134.53

_ 2xxxxx ACCOUNT 1 NAME 16782.36-

Grand Total for 1000: 301352.17

*** Press ENTER to view more SL Accounts ***

Enter-PF1---PF2---PF3---PF4---PF5---PF6---PF7---PF8---PF9---PF10--PF11--PF12---

Hmenu Help EHelp Bkwd Frwd Dload

Input the following into the action lines:

- Subcode 1000 for the All Expense Pool, or other budget pool for SL/SA account

- Desired Fiscal Year

- From Acct

- To Acct

- Thru Month (This will include September through the month specified.)

- Dept and Subdept codes

- SL/SA/GL/BK (Choose SL or SA.)

In the example above, Account 2xxxxx has a negative budget balance of $16,782.360. Next, proceed to either Screen 34/74 or 19/69 for more information about the account.

FAMIS_HT_AcctBal.docx