Federal Time and Effort guidelines indicate that only Institutional Base Salary is to be included in the Time & Effort certification process.

The Time and Effort system determines institutional base pay by obtaining ALL payroll data, excluding only pay that is not part of institutional base salary (IBS).

Over the span of its use, the Time & Effort system has used 3 different rules for determining IBS. These methods are discussed below.

January 1, 2018 and Later

Starting 1/1/2018, in conjunction with the implementation of Workday Payroll, all payroll data sent to Time and Effort is first loaded into FAMIS’ pay details data store. The relevant payroll data is then sent to Time and Effort on a daily basis.

Note: The weekly payroll feed from FAMIS includes all completed payroll cost transfers (PCTs).

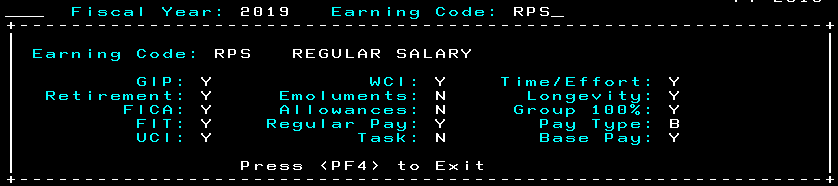

As before, only payroll that is designated as IBS is included in the Time and Effort system, as defined by the Workday earning codes. You can find information about earning codes on FAMIS screen 730 or view complete earning code information in the Earning Codes application.

For example, consider earning code RPS, Regular Salary, which is noted as IBS by the Time/Effort flag:

Research Foundation Accounts

In addition to Earning Codes rules, all Research Foundation accounts defined in FAMIS are excluded from Time & Effort. As one example, consider the account 06-499999 used by AgriLife Research. No payroll charged to this account will appear in Time & Effort, regardless of the earning code assigned to it. Such payroll will flow into Time & Effort on an appropriate account after Research Foundation processing of it is complete.

January 1st, 2011 to December, 2017

Effective 1/1/2011, the BPP payroll system was modified to better accommodate Time and Effort payroll needs. The rules for what pay was included in institutional base pay were changed.

The following were the pay items excluded by the BPP Payroll system:

- Object Code 1610 – Longevity

- Object Codes 1765 through 1780 – Special one time wage object codes

- All Object codes 1782 and higher (employee benefits and other special payment codes)

- Object codes 1480, 1580, 1281, and 1285 (one-time merit payments) effective January 2013

- Pay Type T – Biweekly emolument (non-payroll) payment

- Pay Type U – Biweekly emolument (non-payroll) payment

- Pay Type V – Vacation payment for terminating employees

- Pay Type X – Extra pay supplement

- Pay Type Q – Qatar Supplements

- Payments marked with the new Task Payment flag in BPP

- Supplemental payments codes NOT marked as regular pay – see below.

BPP Supplemental Payment Codes

The TAMUS BPP system allowed for the specification of a “supplemental payment code” on all payments. Normally this code was left blank – meaning that the payment was for regular pay.

Beginning in January 2011, the payment code was required for certain BPP Pay Types. BPP maintained the list of valid codes on screen 420. Each code was marked if it was

- A task payment

- Some sort of regular pay

If the supplemental payment code was NOT blank on a BPP payment record, then this table was interrogated to determine if the pay was for regular pay. If the payment code has the Regular Payment code set to “Y”, then the payment WAS included for effort reporting. If the Regular Payment flag was set to “N” then the payment was NOT include in the Time and Effort system.

Prior to January 1, 2011

Before January, 2011, the following BPP payroll items were excluded from effort reporting:

- Object Code 1610 – Longevity

- Object Codes 1765 through 1780 – Special one time wage object codes

- All Object codes 1782 and higher (employee benefits and other special payment codes).

- Any payment where the supplemental payment code was not blank.

- Pay Type K – Biweekly supplement

- Pay Type P – Biweekly supplement

- Pay Type Q – Qatar Supplements

- Pay Type T – Biweekly emolument (non-payroll) payment

- Pay Type U – Biweekly emolument (non-payroll) payment

- Pay Type V – Vacation payment for terminating employees.

- Pay Type X – Extra pay supplement.