Overview and Background

This paper describes the assignment of employer Group Insurance Premium (GIP) and Longevity (LNG) contributions to the appropriate FAMIS bank and Uniform Statewide Accounting System (USAS) appropriation year, specifically when biweekly payroll crosses the fiscal year boundary of September 1 of each year.

With the state general revenue (GR) fund (state fund 0001), the State of Texas appropriates funds for the employer contribution of the GIP in a separate appropriation number for each appropriation year. Longevity may also be funded from a separate appropriation, and other state funds may also use separate appropriations.

For salaried / monthly paid employees who are funded (either fully or partially) from state funds, the process is straightforward. When their earnings for the September pay period (September 1–30) are processed, their earnings are funded from the new state appropriation, and the GIP and LNG funding follows using the new appropriation number and appropriation year as well. This is done through the FAMIS accounting analysis (AA) table.

For biweekly paid employees, the process is more complex. The full monthly employer GIP contribution is assessed and taken on the first biweekly payroll paid in a month, a practice utilized for the last 30 to 40 years. Longevity is assessed and taken on the biweekly pay period that contains the first day of the month.

With the implementation of Workday, special coding was implemented to ensure that the September GIP and LNG employer contributions were funded from the new year’s appropriation. Due to the timing of pay periods in September 2024, the special coding was no longer effective, and funding for these employer charges from state funds was redirected to the previous year’s appropriation.

Additional Details

- Biweekly pay periods end on Saturday. The actual pay date is always the following Friday, six days after the end of the pay period.

- The State of Texas funds and appropriates a monthly amount for the employer’s share of GIP based on employee counts and the budget process. The funding is often provided in a separate appropriation.

- The Texas A&M University System members plan on spending this GIP appropriation over 12 months.

- Historically (going back to the Budget Payroll Personnel [BPP] application), for biweekly paid employees, the employer contribution for GIP as an employer-paid benefit was charged on the first biweekly pay in any given month. Note that for employees, the deduction amount is split across the first two biweekly periods in a month.

- The process for LNG closely follows that of GIP, but longevity is paid on the biweekly period that contains the first day of the month.

- Before the A&M System Workday implementation, pay periods were cut short and manipulated so that no payroll crossed the August 31 boundary. With the implementation of Workday, this practice was modified to include biweekly periods that cross the August 31 boundary.

Funding for Pay Periods Crossing the Fiscal Year Boundary

State guidance indicates that for employees funded from state funds, earnings should be charged to the appropriation year corresponding to the period during which the work is performed. For example, if six working days of the two-week period occurred in August, 60% of the funding for the earnings should come from the old year’s appropriation, with the remaining 40% coming from the new year.

While this may be true for earnings, the A&M System’s practice for GIP funded 100% of the employer GIP and LNG contributions from the new year’s appropriation. This creates a complex situation for biweekly employees paid from state funds for the first payroll in September, where the GIP and LNG appropriation years may differ from the earning appropriation year.

Understanding Workday Subperiods

The Workday assignment and handling of subperiods are relevant to understanding the funding of employer-paid GIP and LNG and the related challenges.

- In normal circumstances, Workday assigns subperiods for each week of the biweekly period.

- Normally, when the FAMIS integration creates a payroll detail record, it combines those subperiods into a single record showing the pay period as two weeks. Note that there are exceptions throughout the entire fiscal year in which the FAMIS payroll integration keeps payroll details separate by subperiod. An example of this is a change in pay rate. This process of creating multiple pay detail records does no harm, more payroll detail records are simply passed into FAMIS.

- However, when pay periods cross the August 31 / September 1 boundary at fiscal-year end, subperiods received from Workday are preserved in the payroll integration. This is achieved through specialized processing in the Workday-FAMIS integration. Note that Workday can also assign a subperiod if the employee’s compensation rate changes during the regular pay period.

This process in Workday results in employee earnings being separated, or at least closely separated, by fiscal year.

End of FY 2024 and the Problem with the GIP Appropriation Year

At fiscal-year end in August of 2024 and due to the way the pay-period dates fell, a problem occurred for the first time:

- The biweekly pay period was entirely in August, and

- The pay date was in September.

Biweekly payrolls processed in previous years (since the implementation of Workday) always had at least one day of the pay period in the new fiscal year. The existing coding in the Workday-FAMIS integration incorrectly assumed that a certain number of days in the pay period would be in September.

Previous Solution

The coding that was in place attempted to direct GIP and LNG funding to the near-year appropriation in the following manner:

- The incorrect assumption was that some of the pay period would be in the new fiscal year and that there would be earnings in the new fiscal year.

- GIP is normally allocated across all earnings that are GIP eligible. However, the previous coding had an exception for September. This coding would force all the GIP to the earnings in the pay period that was part of the new year.

- In September of 2024, since there were no earnings in the new fiscal year, all the GIP was allocated to the old year’s earnings, and in turn, no GIP was allocated to the new year’s appropriation.

Note that this primarily caused pain and problems for A&M System members when:

- The A&M System member had many biweekly employees who received the GIP benefit.

- Many of these employees were funded from the state funds.

Note that state payroll funded from non-GR funds usually do not have separate GIP appropriations and are also likely able to carry those funds forward. Using the correct appropriation year is less of a significant issue with these non-GR funds.

New Solution for FY 2025

For several reasons, the existing coding to force GIP and LNG to the new year payroll detail records was unsustainable. Separating or forcing GIP and LNG to a separate payroll detail record for just the September 1 biweekly was a significant challenge when no earnings belonged in the new year.

The following solution was developed:

- The GIP and LNG allocation to payroll detail records are simplified and return to the standard approach. GIP and LNG will be spread across all eligible earning records (by UIN and pay period) regardless of the fiscal year.

- The Workday subperiods will continue to be respected for the pay period and pay date that crosses the August 31 boundary.

When state funds are involved, the requirement remains to fund the earnings from the correct appropriation year, which in FAMIS is the correct new appropriation year bank. This is accomplished by using the AA code from the relevant fiscal year, which directs the payroll to be funded from the correct bank account.

The following steps outline the process for determining the AA code for the September biweekly pay period:

- As described above, the payroll records are split according to the Workday subperiod.

- The fiscal year, now also known as the Appropriation Fiscal Year (AFY), of the pay period is determined.

- If the period or subperiod crosses the September 1 boundary, the payroll detail record is assigned to the AFY that contains the most working days.

- If most of the working days for the period or subperiod are in the old year, the payroll detail record will be considered a prior-year AFY record.

- If most of the working days in the period / subperiod are in the new year, this is treated as a new AFY record.

- For other biweekly periods, the payroll detail record is assigned to a fiscal year based on the actual pay date.

- For monthly periods, the payroll detail record is assigned to an AFY based on the pay-period end date (i.e., the last day of the month). This aligns with the accounting effective date of the payroll expense.

- If the period or subperiod crosses the September 1 boundary, the payroll detail record is assigned to the AFY that contains the most working days.

- The Subsidiary Ledger-Support Account (SL-SA) attributes are looked up in the current fiscal year to determine the relevant AA code.

- AA overrides are applied. If this is a prior-year pay period, the prior-year AA override table is used.

- The AA table lookup will be done.

- If this record is a prior-year record, the PRIOR year’s AA table is used for the earnings.

- The NEW (current) year’s AA table is used for GIP and LNG.

This process will drive the GIP and LNG (if any) to the new appropriation year.

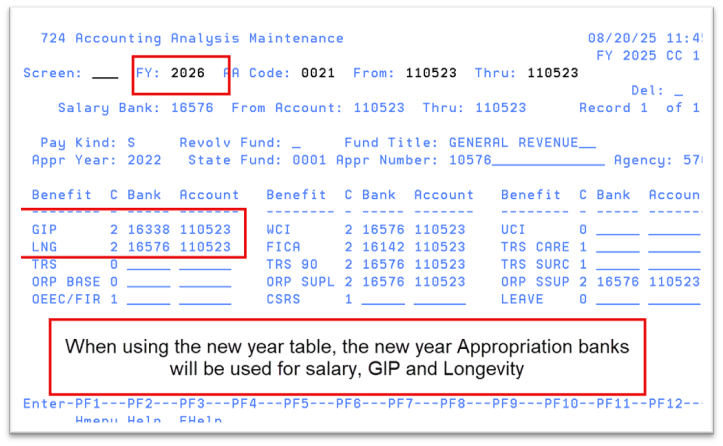

Screen Image Examples

The following screen images contain highlights of relevant data elements.

Notes on PCTs and the Accounting Analysis Table

The described solution for GIP and LNG allocations impacts payroll cost transfer (PCT) processing and the AA table in the following ways:

- If the PCT is for a period that crosses the fiscal year boundary, the same logic is applied to the AA table lookup and the determination of the GIP and LNG charge codes and banks.

- PCTs for prior-year pay periods use the prior-year AA table.

- PCTs for two previous fiscal years (currently, only the Texas Division of Emergency Management [TDEM]) only use the prior-year AA table. A change is being considered. Note the technical problem in routine FBPR061.

- PCTs for prior years DO NOT interrogate the AA override table.

- AA table lookups are handled in routine FNSPPHAA. This applies to batch and PCTs.