Overview

The purpose of this guide is to provide a basic overview of the W-2 and the various calculations used to provide the data Employees see in each box

Overview

A Wage and Tax Statement or W-2 is a report that displays your annual wages and the amount of taxes withheld from your paycheck. Employers are required to send employees the W-2 by January 31st each year so that employees can file their income tax return by the April 15th deadline. The purpose of this reference guide is to provide a basic overview of the W-2 and the various calculations used to provide the data Employees see in each box.

Key Points:

-

- Your W-2 reflects your income from the previous year

- Employers use this form to report FICA taxes to the IRS that have been deducted from employees paychecks

- The IRS uses the W-2 form to determine an employee’s tax liability for the year

- W-2s are available in January within Workday using the Pay worklet

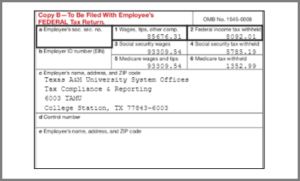

W-2 Overview

Employers are required to send a W-2 to employees and the Internal Revenue Service (IRS) at the end of the year. The W-2 shows your annual wages and the taxes deducted taxable wages earned.

Top Portion

The top portion of your W-2 provides information regarding your wages and taxes withheld from these wages

Box 1

Taxable Wage – is calculated by taking the Total Gross Wages (Annualized Compensation + Annualized Longevity Pay) less the annualized amount for Group Medical, Dental, Vision, and ADD Insurance, Teacher Retirement System, Optional Retirement Program, Tax Sheltered Annuities (403(b)), Deferred Compensation Plan (457 Plan), Tax Saver Plan Spending Accounts (including administrative fee) and any Pre-Tax Parking Deductions. Annualized Compensation includes salary, allowances, and emoluments that are taxable according to IRS guidelines.

Box 2

Federal Income Tax Withheld – the amount of Federal Income Tax withheld from wages

Box 3

OASDI Taxable Wage – is calculated by taking the Gross Wage (Annualized Compensation + Annualized Longevity Pay) less the annualized amount for Group Medical, Dental, Vision, and ADD insurance, health care and dependent care spending, and pre-tax parking

Box 4

OASDI Social Security Tax Withheld – the employee pays 6.2% to a maximum earnings of $132,900.00 for calendar year 2019.This amount changes yearly. The information provided here is specific to 2019

Box 5

Medicare Taxable Wage – is calculated by taking the Gross Wage (Annualized Compensation + Annualized Longevity Pay) less the annualized amount for Group Medical, Dental, Vision, and ADD insurance, health care and dependent care spending, and pre-tax parking

Box 6

Medicare Tax Withheld – the employee pays 1.45% on all earnings up to $200,000.00 and 2.35% on all earnings in excess of $200,000.00 (no maximum) for calendar year 2019. The information provided here is specific to 2019

Bottom Portion

The bottom portion will call out various deductions that depend on the individual’s specific situation and tax elections.

Box 10

Dependent Care Benefits – is the amount deducted for Dependent Care Spending Account –Navia

Box 12

The IRS uses Box 12 to report various types of deductions with a code. Specific code information and corresponding deductions are provided below.

Code E: 403 (B) Deferrals – This is the amount of pre-tax contributions made to a Tax Deferred Account.

The Tax Deferred Account deductions are:

-

- TDA –AIG RETIREMENT SERVICES

- TDA – FIDELITY INVESTMENTS

- TDA – ISC GROUP, INC.

- TDA – LINCOLN FINANCIAL GROUP

- TDA – METLIFE RESOURCES

- TDA – METROPOLITAN LIFE INS CO.

- TDA – PENTEGRA RETIREMENT SERVICES

- TDA – SECURITY BENEFIT LIFE

- TDA – TIAA-CREF

- TDA – USAA LIFE INS/INV MGMT

- TDA – VOYA

Code G: Elective 457(B) Plan – is the amount contributed to the Texa$aver Deferred Compensation Plan – 457 Plan. This is a pre-tax deduction.

Code BB: Designated Roth Contributions under the 403(B) Plan – the amount contributed to the Roth 403(b) plan. Roth contributions are after tax contributions.

The Roth 403(B) deduction codes are:

-

- TDA –AIG RETIREMENT SERVICES – Roth

- TDA – FIDELITY INVESTMENTS – Roth

- TDA – ISC GROUP, INC. – Roth

- TDA – LINCOLN FINANCIAL GROUP – Roth

- TDA – METLIFE RESOURCES – Roth

- TDA – METROPOLITAN LIFE INS CO. – Roth

- TDA – PENTEGRA RETIREMENT SERVICES – Roth

- TDA – SECURITY BENEFIT LIFE

- TDA – TIAA-CREF

- TDA – USAA LIFE INS/INV MGMT

- TDA – VOYA

Code DD: Cost of Employer Sponsored Health Coverage – this is the total cost (employer + employee) for the Medical A&M Care, Medical Grad Plan, Medical J Plan, and the Wellness Credit.

Code EE: Designated Roth contributions under 457 Plan – this is the amount contributed to the Texa$aver Deferred Compensation Plan – Roth. Roth contributions are after-tax contributions.

Box 14

Other – Amounts paid for qualified sick leave wages or qualified family leave wages under the Families First Coronavirus Response Act taken during the time period of April 1 and September 30 for the year 2021 are reportable if the company claimed a credit for the leave on their Form 941. Specifically, up to three types of paid qualified sick leave wages or qualified family leave wages are reported in Box 14. The three types include:

-

- EPSL$200 – sick leave wages subject to the $200 per day limit and $2,000 in aggregate because of care you provide to another

- EPSL$511 – sick leave wages subject to $511 per day limit and $5,110 in aggregate because of the care you required

- EFMLEA – Emergency Family Leave Wages up to $200 per day or $12,000 in aggregate

Additional information can be located in IRS Notice 2021-53

Retirement Plan Check Box

All employees participating in a retirement plan will have this box checked.

For questions please call your local payroll office. TAMU employees please email tax@tamu.edu