Overview

Provides guidance on how a Payroll Partner accesses and navigates a Worker's Pay Results

Page Loading...Checking SSO..

Overview

The reference guide Understanding Your Worker’s Pay Results walks Payroll Partners through the process of accessing and reviewing an Employee’s pay results in Workday. The reference guide provides detailed descriptions of the key tabs on the Payment Details page and along with other additional pages.

Key Points

-

- For more information on how to navigate the Payment Details page, locate the online course Workday Payroll for Payroll Partners.

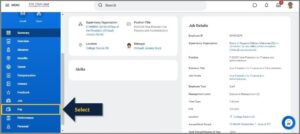

Accessing a Worker’s Pay Results

- From the Homepage, navigate to the Search Bar to and enter the name of the Employee whose Pay Results you would like to review.

- Select the Employee’s Name.

- From the Employee’s worker profile, select Pay application.

- After selecting Pay, you will be defaulted to the Results tab.

- Select the Magnifying Glass icon in the Payroll Result column for the the payment date you wish to review.

- After you land on the Payment Details page, you will discover multiple tabs. You will be defaulted to the Gross to Net tab. Below you will find an explanation of what you will find within each of the individual tabs.

Payment Details Page Tabs Overview

-

- Gross to Net (Default Tab). Lists all sources of gross income for the Employee (i.e., regular salary, regular hours, longevity, extra pay, communication allowances. Shows all Employee (EE) Benefits, TRS or ORP Contributions, Taxes or Other deductions from their paycheck such as Parking, Rec Sports fees, Withholding Orders/ Garnishments, Charitable Contributions, etc.

-

- Additional Pay Components. Reflects a partial list of all Employer-Related (ER) expenses associated with the pay period. Emolument entries show on this page. Complete Employer-related expenses are available in FAMIS.

-

- Payroll Input (only visible if applicable). Shows any inputs set-up to drop into a pay result; may also include any manual entries made by Payroll.

- Pay Accumulations/ Balances. Provides numbers that may be used for departmental review of FYTD & YTD Totals; Benefits Arrears may show here.

- Tax Elections. Displays the tax elections chosen by Employee during onboarding or updated at a later date are shown here.

- Payroll Input (only visible if applicable). Shows any inputs set-up to drop into a pay result; may also include any manual entries made by Payroll.

-

- Payment. Informs whether the Employee is being paid via direct deposit(s) or check; check number will be listed. Payment elections are an Employee self-service function in Workday.

-

- Actuals. Contains details that are part of the Pay Calculation results for a Period Report including costing allocations that indicate the accounts being used to pay the Employee.

Additional Page Examples:

-

- Time Entry Tab. Shows approved hours entered on a timesheet that drop to the current pay results.

Note: Approved Paid Time Off (accrued vacation, sick, etc.) will drop separately to pay results, even if timesheet is not submitted.

-

- FLSA Tab. Details for the bi-weekly pay period; each week is separate.