Overview

Provides guidance and control of the production of the monthly and biweekly payrolls

Overview

The Pay Cycle Event is a business process designed to provide guidance and control of the production of the monthly and biweekly payrolls. The Workday Services Operations team and the Payroll Partners at each workstation have specific responsibilities that must be completed within each Payroll Cycle. The purpose of this guide is to provide a step-by-step resource for Payroll Partners who participate in this process.

Key Points:

-

- Use the Workday Production Calendar to determine when each Pay Cycle will be initiated and completed. The Workday Production Calendar is located on the Workday Help Site.

- There are only 2 tasks that the Pay Cycle Event automatically performs: the Initial Run Pay Calculation and the Run Pay Complete.

How the Pay Cycle Event Works

The Workday Production Calendar determines when each Pay Cycle will be initiated and completed. The In Box items alert the Payroll Partner that the Pay Cycle Event has started and the various reports and tasks that need to be completed. The Payroll Partner must complete the To Do steps ensuring that each step is completed by the deadline specified by the Workday Production Calendar. The Workday Services Operations team begins the Payroll Completion step of the business process, at 9:00 a.m. on the payroll completion date specified on the Workday Production Calendar. IMPORTANT: Workstations should plan on having all data entry completed prior to this time.

Five Steps

Step 1. Workday Services Initiates the Pay Cycle Event which initiates the Run Retro Pay Calculation

WDS Payroll Administrators receive a To Do in Workday. When the Run Retro Pay Calculation has completed, the administrators will submit the To Do. This then triggers the Run Pay Calculation and sends the Payroll Partners their Workday inbox items.

Step 2. Review Payroll Calculation Results

The Payroll Partner will receive an inbox task Review Payroll Calculation Results. When the Payroll Partner submits this task a sequence of four To Dos will follow to guide them through the process. The first two are focused on Retro and the second two are focused on payroll processing.

-

- To Do: Review Retro Payroll Results

Follow the directions. A helpful report is Payroll Retro Change for Group of Workers. Submit and then move to the next To Do.

-

- To Do: Complete Retro Payroll Results

Run the task Run Retro Pay Complete. Then submit and move to the next To Do.

-

- To Do: Review Reports for Payroll

You will need to review the following reports. These reports are available on the Pre-Payroll Dashboard.

-

-

- Payroll Retro Changes for Group of Workers

- Payroll Input by Worker(s)

- Business Process Transactions Awaiting Action

- Pay Calculation results for Group of Workers

- Pay Calculation Results Summary

- Audit-Pay Calculation Results for a period

- Audit-Pay Calculation Results Comparison to a prior period (Period Summary)

- Audit-Pay Calculation Results Comparison to a prior period (By Pay Group)

- Audit-Pay Calculation Results Comparison to a prior period (By Worker)

- Payroll Accounting by Company/Period

- Review Payroll Register

- To Do: Confirm Payroll Complete

-

You will review your pay group(s). When you submit this To Do, Workday Services Operations is aware that your payroll is ready to be finalized.

Step 3. Workday Services Operations Payroll Administrators Run Pay Complete

Workday Services will run the pay complete for on and off-cycle payments. A Run Pay complete task is submitted for each member. This will automatically process the Run Pay Complete task. When submitted it is time to settle payroll.

Step 4. Workday Services Settlement Specialist Settles Payroll

Workday Services receives a To Do to create, edit, preview, and process settlement runs to settle unpaid open items and pending payments for each Member. When this To Do is submitted, a To Do routes to the Member’s Payroll Partner and Tax Compliance Partner.

Step 5. Complete Tax Filing Data Periodic Data by Company

The Payroll Partner or Tax Compliance Partner for the Member receives a To Do to complete the tax filing data for the company.

Complete the Tax Filing Data Periodic Data by Company

The To Do provides instructions for the Payroll Partner / Tax Compliance Partner to view the tax filing data for selected periods, pay run groups, and/or pay groups. This step enables the Payroll Partner /Tax Compliance Partner to reconcile the company periodic tax liabilities.

When this To Do is submitted, the Pay Cycle Event is completed for the Member.

Payroll Manager Responsibilities

The Payroll Manager needs to review the process monitor to determine that all payroll entries are in a status of In Progress. The WDS Operations team can’t complete payroll entries if the entry is not in an “In Progress” status. The best practice is to complete all data entry by 5:00 p.m. the day before the payroll completion date. The Payroll Partner can locate the tasks and reports referenced on the Inbox Action and “To Do” items in the Pre-Payroll Dashboard under the Command Center tab.

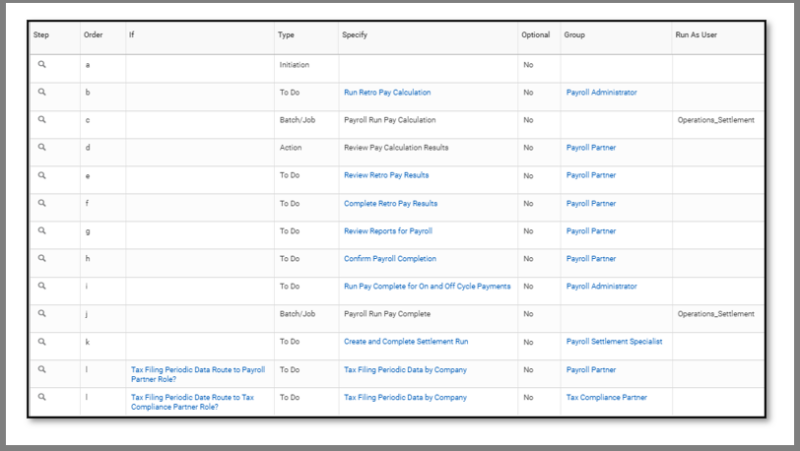

Viewing the Pay Cycle Event in Workday

The Standard View of the Pay Cycle event is below. Notice that most items read “To Do”. That is because the Pay Cycle Event provides you with a step by step To Do list of items you will need to complete. There are only 2 tasks that the Pay Cycle Event automatically performs: the Initial Run Pay Calculation and the Run Pay Complete.