Overview

Provides details on how to use the custom report to analyze retro events that are impacted by the TRS rate change and require manual adjustments going forward

Overview

The Teacher Retirement System (TRS) Employee and Employer contribution rate will change effective September 1, 2021. This means that any retro events that take place and pay out to the individual after this date, will need to have a manual adjustment to include the new rates.

The TRS Rate Change Analysis report is a custom Workday report developed to help Payroll Partners identify retro events that may need action taken to ensure the correct TRS contribution is made to TRS in a timely manner. The purpose of this reference guide is to provide details on how to use the custom report to analyze retro events that are impacted by the TRS rate change and require manual adjustments going forward.

Key Points:

- The Employee and Employer contribution is based on TRS eligible compensation paid, not when earned

IMPORTANT: the TRS contribution rate is based on payment date, not the pay period.

- The pension surcharge is due from the Employer when a TRS Retiree exceeds half time work in a calendar month

- Be Advised: This rate change will apply to the August 2021 monthly pay period with a payment date of 09/01/21

- The biweekly payrolls with a pay date in August 2021 are calculated at the current rate. The current TRS member contribution rate is 7.7%, the TRS Employer Contribution Rate is 7.5%, and the TRSS rate is 15.2%

Rate Changes and Pay Component Impacts

The changes in the TRS rates will impact the following Pay Components: TRS EE, TRS ER, TRS9 EE, TRS9 ER.

-

- Employee Contribution Rate = 8.0% (Previously 7.7%)

- Employer Contribution Rate = 7.75% (Previously 7.5%)

The change in the TRS surcharge rate will impact the following Pay Component: TRSS

-

- The pension surcharge rate = 15.75% (Previously 15.2%)

General Rules

- Any new payments (gross pay was not paid) in a prior pay period must use the new TRS rates

- Any adjustments to the TRS Covered Wages paid on a payment date prior to 9/1/2021 must use the prior contribution rate

- The Retro payroll processing will use the previous TRS contribution rate for any payroll with a period end date prior to 8/31/2021

About the Report

The TRS Rate Analysis report narrows down the retro entries to those that may need a correction entry for the TRS contribution rate and amount. The report provides all the components that need to be reviewed including:

-

- Pay Component

- Original Pay Period

- Retro Pay Period (target payroll)

- One-Time Payment/Activity

- Earning Difference

- Deduction Difference

- Contribution Percentage

The report is used to determine needed action by the Payroll Partner Role. Correcting entries may be required based the situation. A reference chart is provided to help in analyzing the entries and determining if corrective action is needed.

Reference Chart for Corrective Action

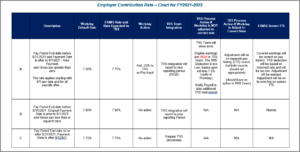

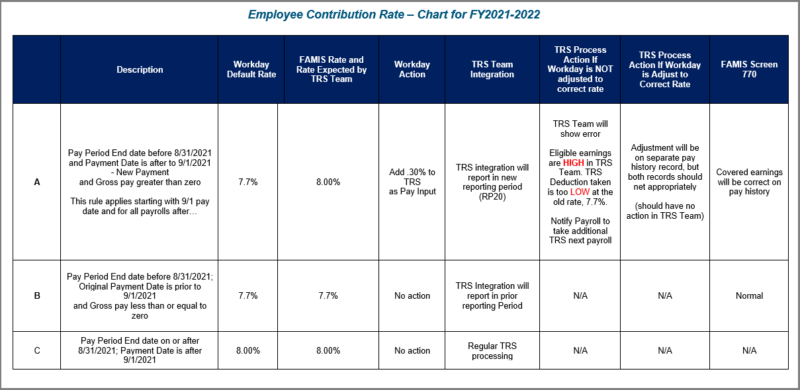

The chart below provides information on how and when the TRS Employer or Employee contribution rate is used within Workday and will help in determining what action is needed by the workstation when reviewing retro reports and/or the new TRS Rate Change Analysis report.

Retro entries for a new payment require corrective action by the Payroll Partner if:

-

- the gross pay is greater than zero, and

- the prior pay period has an end date before 8/31/2021, and

- the Payment Date is after to 9/1/2021

The chart describes three situations. The chart also reflects the impact on TRS Teams and FAMIS for reference.

Scenario A: The Payroll Partner must complete a Payroll Input for the additional TRS Employee and Employer contribution amount to be deducted from the Worker’s pay result. Actions to take are described in the next section of this reference guide.

Situation B: Requires no action

Situation C: Requires no action

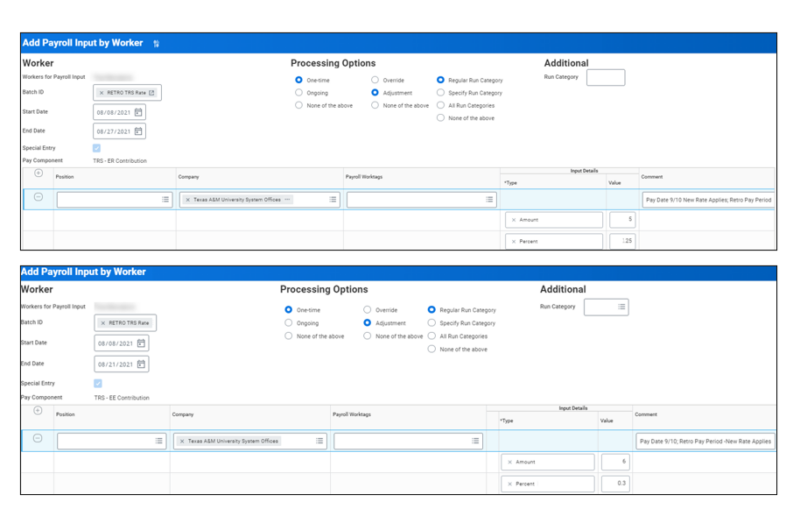

Taking Corrective Action

Only Situation A from the chart above requires a corrective data entry to be made by the Payroll Partner. The Payroll Partner will complete a Payroll Input for the additional contribution amount to be deduct from the Worker’s pay result. This is done be completing a Pay Input to deduct the additional contribution amount for the Employer and Employee contributions. The data entry is a Payroll > One-Time > Adjustment. See Example below: