Overview

This guide provides an overview of the various components typically found on a payslip generated by Workday so you can use this data to make important decisions relating to payroll, insurance, and other benefits relevant to your employment

Overview

Workday provides a comprehensive view of your pay, deductions, and relevant accruals through your workday payslip. You can access your payslip through the Benefits and Pay Hub through the Workday Menu. The purpose of this guide is to provide you an overview of the various components typically found on a payslip generated by Workday so you can use this data to make important decisions relating to payroll, insurance, and other benefits relevant to your employment.

Key Points:

-

- Your payslip may differ from the screenshot in this guide depending on your position, earnings, deductions, and other factors

- Employees eligible for Time Off will see relevant balances if time off was taken during the pay period for that payslip

Access your Payslip

Employees access their payslips in Workday through the Benefits and Pay Hub.

Go to Pay > Payments to see all payment information.

Scroll down to the All Payslips section, which displays the last 10 payslips in chronological order with the most recent on top. Select the View all Payslips button to see all previous payslips.

View a Payslip

To view a specific payslip, you will need to click View next to the payslip you would like to review. If you work more than one job for multiple companies within the Texas A&M University System, you will have multiple payslips. See an example below for the Employee who has multiple positions across members.

Payslip Overview

The top portion of your payslip provides a general overview of the system member that generated the payment, your personal information, and the period for which you are being paid.

Current and Year-To-Date (YTD) Totals

This section of your payslip summarizes the current pay period as well as the accumulation of these details since the beginning of the fiscal year. This is the high level overview of what you are paid and what deductions are removed both before and after taxes in order to determine your final net pay. Your Net Pay refers to what you take home. This is the amount on your paycheck or the amount deposited into your bank account(s) as set up in your payment elections in Workday.

Payslip Details

The middle portion of your payslip provides more specific details on what is outlined in the Current and YTD Totals section above. Each of the following areas described may not appear on all payslips due to the varying positions and personal elections for each Employee.

Earnings

The earnings section lists each type of earning received during this pay period, and your YTD totals. Examples include but are not limited to: Base Pay, Longevity Pay, and Lump Sum Vacation Payouts. If you are a salary paid employee, it displays the Base pay with the Amount of that pay period and the YTD totals. Any additional pay for the pay period will be listed here as well. If you are an hourly paid employee, it displays the Hourly Pay with the total hours you worked and the rate of pay, and the amount you earned of that pay period as well as the YTD totals. The rate is determined according to your position and compensation details.

Deductions

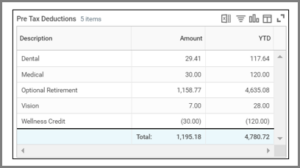

Pre Tax Deductions

Pre-tax reductions are deducted from your pay before taxes are calculated, such as life insurance, medical, dental, retirement and more. You may also see items like parking fees and your Wellness credit (if applicable).

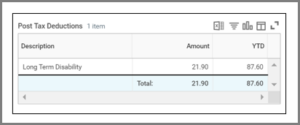

Post Tax Deductions

These deductions are taken after taxes are calculated. It includes items such as Long Term Disability as shown below.

Taxes

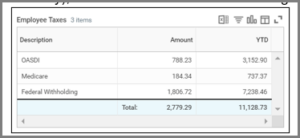

Employee Taxes

This section lists the amount deducted from your paycheck to pay employment taxes. This includes OASDI (Referred to as Social Security), Medicare and Federal Withholdings.

Note: OASDI stands for Old Age, Survivor and Disability

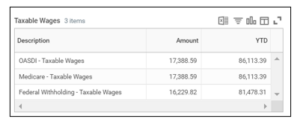

Taxable Wages

This section lists the total amount of wages you received on which you were taxed. This explains the totals you see under Employee Taxes shown here on the left.

Note: OASDI limits the amount of earnings subject to taxation for a given year. The limit changes each year. For information on the limit visit the social security website and search for Contribution and Benefit Base

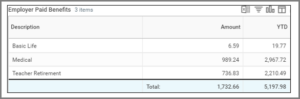

Employer Paid Benefits

Here you will see a summary of the amount your employer paid on your behalf for various benefits you are eligible for based on your position. These include medical premiums, life insurance and retirement programs like TRS (Teacher Retirement System).

Withholding

The Withholding section identifies what you currently have documented on your W-4 at the time payroll was processed. Your Federal Tax Withholding Elections can be updated at any time in Workday. Based on the timing of your update, the change may not reflect until the next pay period.

Payment Information

Payment information details the Net Pay amount you received and method (check or direct deposit) of the payment. If your funds are distributed over multiple accounts, you will see one row per account with the amount of funds deposited. If you were paid by way of a paper check, the check would have been sent to your mailing address the day before payday.

In this example you see the Bank Account Name is the same as the Account Number. If you do not change the name of your account, it will default as the account number. It can be helpful to name the account in case you decide to add an additional bank account in Workday. For example, you might name one account Checking and the other Savings to differentiate between the two accounts associated with your profile.