Overview

The purpose of this guide is to provide further information on the accounting impact of payroll reversals. Work with your payroll accountant to complete the entire process

Overview

Reversals are Off Cycle calculations that reverse a completed pay calculation. A reversed payroll result will cause all previous positive entries to show as negative and all previous negative entries as positive. A reversal is to ‘zero out’ or void the previously completed pay result. These entries will in turn be passed to the appropriate system member’s accounting system.

The purpose of this guide is to provide further information on the accounting impact of payroll reversals. Work with your payroll accountant to complete the entire process.

Key Points:

- A pay result for the Employee must be in a completed status and the following information will be needed: Reporting Group, Reporting Pay Group Detail, Reversal Date and Action Reason.

- This process does not retrieve funds from the Employee or reverse an ACH bank transfer. Please work with your accounting staff to recover funds from the employee and make the appropriate accounting entries.

- Things to consider when entering a payroll reversal are the impacts to the general ledger, positive pay and check reconciliation, direct deposit and taxes.

Completing Reversals in Workday

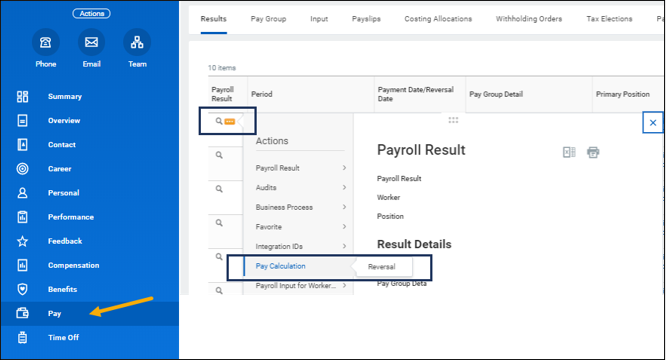

Reversals are completed from the Employee’s Worker Profile by navigating to the Pay link and then the Results page. The Payroll Partner or Payroll Administrator will select the Related Action icon and select Pay Calculation > Reversal. Note: A reversed payroll result will no longer display in the self-service payslip page.

FAMIS Details

Recovering Net Pay

Workday reversals do not recover net pay from the Employee. If the Employee is normally paid by ACH, the reversal process does not attempt to send through a reversing ACH to recover the funds the from the Employee.

Funds must be recovered from the Employee using one of the following methods:

-

- If caught in time, the original ACH for net pay may be able to be cancelled before it is processed

- The check could be intercepted and voided.

- The employee may need to manually reimburse the system member (e.g. write a check or transfer funds back to the System Member).

Pay Type and Impact on Payroll History

Payroll Reversals entered in Workday will receive special handing in the Workday to FAMIS payroll integration. FAMIS will mark the payroll history record as Pay Type “C”. This treats the payroll detail as a cancellation.

Note: This is the same process that took place in the previous payroll system (BPP).

Payroll Reversal Impacts

-

- Employer paid benefits (e.g. the employer side of OASI, WCI, or UCI), are all reversed. No special action is needed. Payments to benefit vendors will be reduced and request for state fund reimbursement (via USAS) may also be reduced.

- The accounting for Employee paid deductions (e.g. FIT, Employee TRS) is reversed. Reports that reflect deductions owed will display reduced amounts.

- If the funds for Employee deductions have been forwarded on to the final recipient, special handling may be required. For example, funds for a withholding order, ORP payment, or TDA may need to be retrieved via special process with that recipient. In some cases, the payroll office may be able to net the reversal against deductions for the next period (e.g. SECC contributions).

- Payroll expenses booked to FAMIS SL accounts will be automatically reversed. Cost allocations may need to be reviewed to ensure the reversal matches the original payroll allocation.

FAMIS Actions Needed

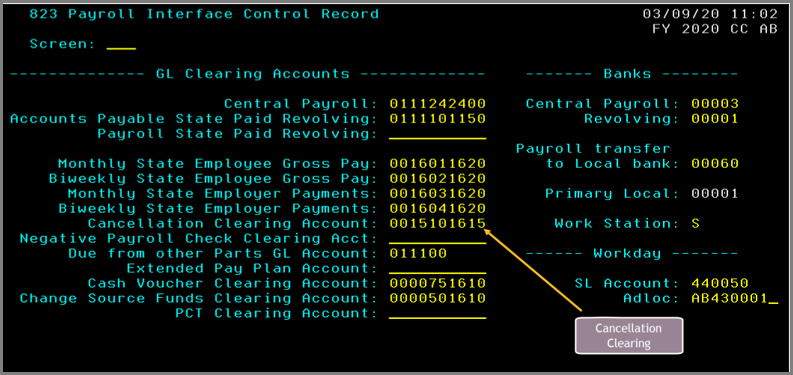

- Since no check or ACH is produced, the offset in FAMIS for the Employee’s net pay will be posted to the FAMIS Payroll cancellation clearing account. See the figure at the end of this guide. The account will hold the debit for net pay that will need to be cleared

- The funds in the FAMIS Payroll cancelation clearing account can be credited to that account:

- If the Employee was paid by check, the original payroll check can be voided in FAMIS on Screen 110.

IMPORTANT: The payroll office should have the check in their possession before taking this approach

The FAMIS payroll integration manual can be consulted for detail accounting information on cancellations and reversals.