Overview

Outlines the necessary background information for a Payroll Partner to add a Payroll Input in Workday

Page Loading...Checking SSO..

Overview

This reference guide outlines the necessary background information for a Payroll Partner to add a Payroll Input in Workday.

Key Points:

-

- Adjustment Payroll Inputs and an Override Payroll Inputs are handled differently.

- After a payroll result is completed, the batch ID can no longer be deleted.

- When adding a payroll input for FLSA, use the Start and End dates that correspond to the appropriate FLSA period.

General Information

A Payroll Input enables the Payroll Partner to add, adjust, or override payroll calculations.

A Payroll Input can either:

-

- Add or subtract an amount from a pay component result.

- Replace a pay component result with a different value.

- A payroll partner can create a one-time payroll input or an on-going payroll input that reoccurs each pay period.

Adjustments vs Overrides

Adjustments and Overrides are handled differently.

-

- If an Adjustment Payroll Input is entered, Workday will continue to display the initial calculation and creates an additional entry to increase or decrease a payment

- If an Override Payroll Input is entered, Workday will completely replace a calculated amount with the payroll input amount.

Pay Periods

When a pay period is divided into multiple sub periods, Workday applies the following rules for payroll inputs:

-

- For one-time payroll inputs: Workday Processes the entire input in the sub period that has the input end date

- For ongoing payroll inputs: Workday resolves the payroll input in each sub period, and applies proration if specified

- For gross net proration: the worker eligibility for the pay component, deduction code, is set to resolve only once per pay period

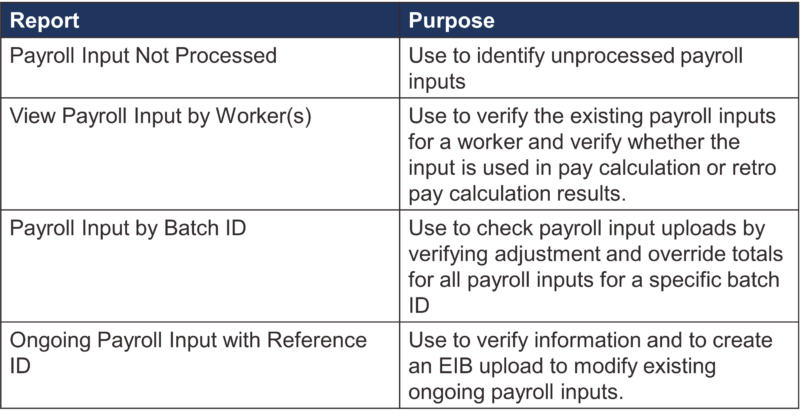

Reports

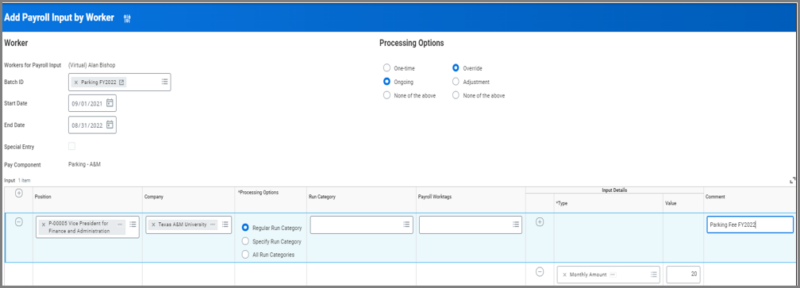

Payroll Input Fields

-

- Worker: Employee Name or UIN

- Batch ID: Create a batch ID or assign an existing batch ID. Allows entries to be tied to and accessed in batch mode

- Start Date: Payroll Start Date

- End Date: Payroll End Date

- Special Entry: Entries not available in Pay Component field

- Pay Component: Earning or Deduction Code for entry

- One-time: Payment will be processed once, regardless of end date

- Ongoing: Payment will be processed on an ongoing basis through the end date specified

- Override: An override will override existing input for a pay component with the exception of hours or amount coming from Time Tracking

- Adjustment: Adds/subtracts from existing pay components

Add Ongoing Payroll Input Process

Use one of two options:

-

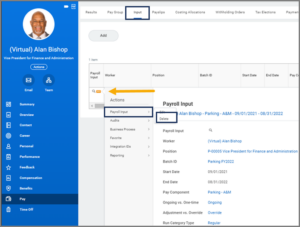

- Add Payroll Input by Worker task.

- From the Worker profile, select the Actions button and select Pay > Add Input.

Add Payroll Input by Worker

Edit or Delete Payroll Input Process

Edit or Delete Payroll Input Process

-

- Navigate to Input Tab.

- Delete is only available if the Payroll Input has not be used in a completed Pay Result.

- If it has been used in a completed Pay Result, the Payroll Input must be edited and end-dated.

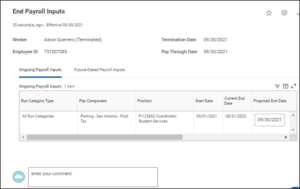

End Ongoing Payroll Inputs Overview

- The sub process End Ongoing Payroll Inputs initiates during a Termination event only when

- Employee has ongoing payroll inputs starting on or before their Termination Effective Date and ending after the current pay period end date.

- This saves time and reduces the manual effort needed to track and end those inputs, such as when an Employee is rehired with payroll inputs from previous jobs.

- Payroll Partner will End Ongoing Payroll Input task to:

- End current ongoing payroll inputs.

- View future-dated inputs starting after the Termination Date for manual deletion.

End Ongoing Payroll Inputs Key Points

- Proposed End Date of ongoing payroll inputs will default to the Termination Effective Date.

- Ongoing payroll inputs with a future start date must be manually deleted by Payroll Partner.

- Payroll Partners can use the View Payroll Input by Workers report to identify ongoing payroll inputs with a future start date.

- If the Termination event Effective Date is corrected after the Termination business process and End Payroll Inputs sub process are completed, the date change will not be automatically reflected on the pay input end dates. Payroll Partner may need to submit a new payroll input for the end-dated payroll input.

- If the Termination event is rescinded, the End Payroll Inputs sub process will be rescinded.