Overview

The purpose of this reference guide is to outline when the Benefit Partner will need to take action and to give explanations for that process. Information on benefit coverage, SGIP, handling arrears, summer billing and military leave dependents is also provided

Overview

A Leave of Absence is an unpaid job-protected leave status. This type of leave should be used when a full-time Employee needs to take a leave of absence that is continuous, unpaid and for a duration of 30 days or more. A benefit event is needed when the absence will encompass at least one entire calendar month.

The purpose of this reference guide is to outline when the Benefits Partner will need to take action and to give explanations for that process. Information on benefit coverage, SGIP, handling arrears, summer billing and military leave dependents is also provided.

Key Points:

- If the Employee is taking Paid Time Off, a Leave of Absence should not be processed

- The following benefit events are triggered by the Request Leave of Absence Business Process and are based on the leave type selected

- Leave of Absence (FMLA)

- Leave of Absence (Non – FMLA)

- For summer billing, a benefit event is not needed, but other tasks will need to be completed by published deadlines. Typically, these deadlines are emailed out in March/April

Taking a Leave of Absence

A full-time Employee might initiate a leave of absence for themselves or be placed on a leave of absence by an Absence Partner or the Employee’s Manager. There are two broad categories of leave types: The Family and Medical Leave Act (FMLA) and Non-FMLA.

FMLA is a protected type of Leave of Absence that allows Employees to keep their employer contribution (SGIP) while they are on leave for certain reasons. Other leave of absences can be categorized as non-FMLA. This section outlines what happens based on the type of leave taken.

Leave of Absence (FMLA)

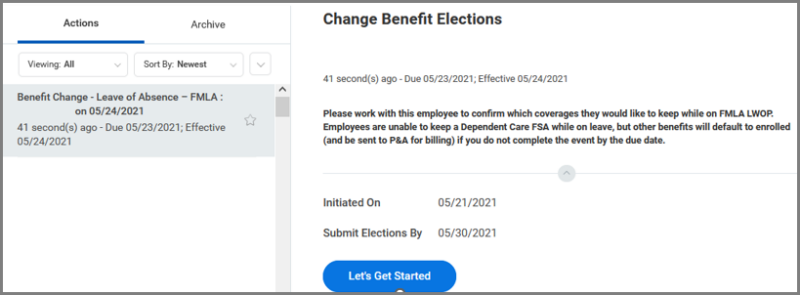

When a Leave of Absence with a FMLA type has been initiated, a benefit event will trigger automatically and a change benefit elections task will route to the Benefits Partner’s inbox to complete.

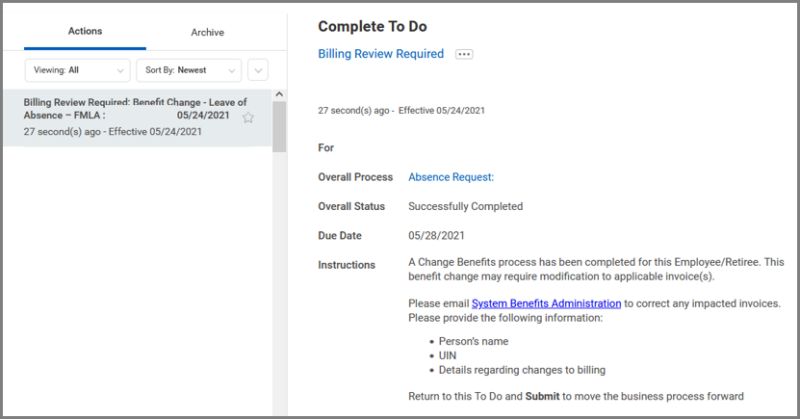

The Benefits Partner will have 7 days to confer with the Employee and complete the enrollment. If the Benefits Partner does not submit the benefit event within those 7 days, the event will be finalized and any benefits will default to the Employee’s current coverage (with the exception of Dependent Care Spending which is not allowed while on leave). The Benefits Partner will then receive a To Do step to email System Benefits Administration (SBA) to ensure that the Employee is set up for billing.

Leave of Absence (Non – FMLA)

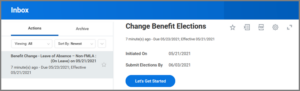

When a Leave of Absence with a non-FMLA type has been initiated, the benefit event will also trigger automatically. In this case, however, the change benefit elections task will route to the Employee’s inbox to complete.

A notification is sent to the Benefits Partner when this event is created. The Employee will have 14 days to make their benefit elections and complete the task.

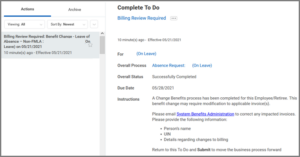

Once the Employee submits the event, the Benefits Partner will receive a To Do step to email SBA to ensure that the Employee is set up for billing. If the Employee does not enroll within those 14 days, the benefit event will be finalized, and any benefits will default to “waive”. The task will then automatically be removed from the Employee’s inbox.

Returning From a Leave of Absence

When an Employee returns to work and the Return Worker from Leave business process has been initiated, there are specific tasks that the Benefits Partner will need to complete. This section looks at benefit coverage, SGIP, and handling arrears.

Coverage and SGIP

After an Employee has returned from leave (through the corresponding business process), the Benefits Partner will receive a To Do to add a benefit event of “Return from Leave” and work with the Payroll Partner and SBA, if needed. Benefits coverage will be effective as of the benefit event date entered by the Benefits Partner when this business process was initiated. This will occur regardless of whether the effective date falls in the middle of the month. SGIP is also available as of the benefit event date entered.

Arrears

While an Employee is on a Leave of Absence, their benefit deductions continue to process in Workday and will go into arrears. When the Employee returns, the Benefits Partner will need to verify whether the Employee paid their premiums through SBA, and may need to work with the Payroll Partner to zero out any premiums that were already remitted through SBA or P&A.

Useful Reports

The following are some useful reports to determine arrears balances and missing leave benefit events:

- Pay Calculation Results – Outstanding Arrears Balance Composite – You may need to request this report from the Payroll Partner. It will display outstanding arrears balances.

- SGIP Discrepancy – This report will display Employees who may be missing a Leave of Absence benefit event. The issue could be related to an Employee’s Leave of Absence if the message reads:

- Person is in a Non-SGIP Benefit Group and is receiving an employer contribution – Further research is needed. If the SGIP Date Driver is “C”, redo the hire event. If the Employee is On Leave, add a leave event

- Person is in an SGIP Eligible Benefit Group with no medical employer contribution – Add or Finalize an Employer Contribution Available event with the appropriate date

Summer Billing

Employees can be set up for summer billing if they have an appointment of less than 12 months and they do not have enough money on their paycheck to pay their 4 months of premiums in May.

- If a Summer Premiums Custom ID of “B” is entered before the announced deadline, the premiums will go over on a file that Workday Services emails to SBA.

- If the Custom ID is updated to “B” after the deadline, the Benefits Partner will have to contact SBA to have the Employee set up manually for billing. You can use the template found on the SBA website to send the information to SBA.

During the summer, an Employee’s premiums will not go into arrears through payroll. When the Employee returns in the fall, the Benefits Partner will need to confirm that the Employee paid their premiums through SBA. If the premiums were not paid, the Benefits Partner will need to have payroll add extra deductions to take the premiums out of the Employee’s September paycheck.

Military Leave Dependents

Dependents of Employees on Military Leave are allowed to keep the Employee’s coverage while the latter is deployed. The Benefits Partner will need to:

- Complete the task Place Worker on Leave and turn off all coverages that impact the dependents. For steps on placing an Employee on leave, refer to the job aid Leave of Absence (Place or Return Worker)

- Set up ONE of the dependents as a “Military Leave Dependent” NEBO (Non – Employee Benefits Only) to be sent to SBA Billing

Premiums will reflect the appropriate SGIP, for example, Employee & Family Coverage: Employee is deployed and placed on a leave of absence. The spouse is set up as Military Leave Dependent NEBO. Children are added to the spouse’s NEBO record and they are set up with Employee and Child coverage (with SGIP). The Military Leave Dependent remits payment to SBA.