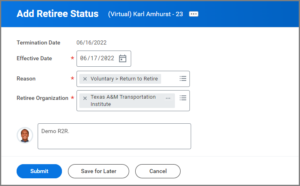

This job aid describes the process for the Benefits Partner to Add Retiree Status to a Terminated Worker’s record and how to initiate a Change Benefits Event when the Employee is Returning to Retire.

Return to Retire (Worker Already in Workday)

Prerequisites

The Employee should have met with their member’s human resources office to confirm TAMUS retirement eligibility.

Important Information

- The Ready to Retire Other ID should not be entered for someone who is returning to retire. Add Retiree Status can be a stand-alone business process from a terminated Worker’s related actions initiated by the HR Partner or Benefits Partner.

- The Organization for Billing Other ID maintains the identification of the Supervisory Organization from which the Employee retired in a format that will drive reporting requirements to legacy systems to assist in determining the organization that will pay the SGIP.

- TAMUS continues to pay a portion of a former Employee’s State Group Insurance Program (SGIP) insurance premium after retirement. The Retiree Percent Local Other ID will maintain a percentage amount representing what portion of the SGIP is paid from Local Funds versus State Funds and will drive reporting requirements to legacy systems.

- The Retiree Retirement Program Other ID maintains the type of retirement (TRS, ORP, or ERS) and is used for billing insurance premiums.

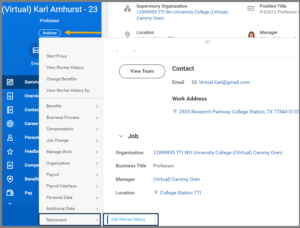

Getting Started

Up Next

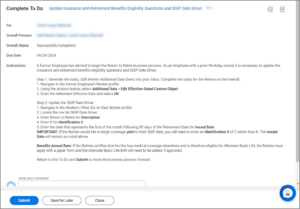

To Do: Update Insurance and Retirement Benefits Eligibility Questions and SGIP Date Driver (Benefits Partner)

The Benefits Partner will receive a To Do to update the Employee’s insurance and retirement benefits eligibility questions, as well as the SGIP Date Driver.

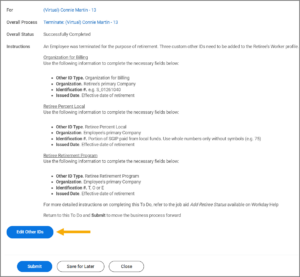

To Do: Update Retirement Other IDs

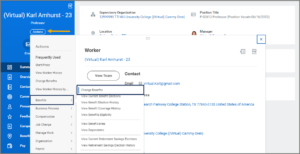

The Benefits Partner will receive a To Do to add three Other IDs for the Retiree using the the Edit Other IDs business process.

Note: Alternatively, you can do this by navigating to the Worker’s Profile and selecting Actions > Personal Data > Edit Other IDs.

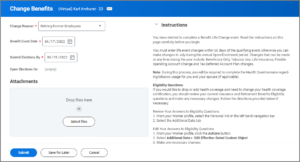

On the Edit Other IDs page, you will enter three additional Other IDs: Organization for Billing, Retiree Percent Local, and Retiree Retirement Program. Follow the directions below for each Other ID.

Organization for Billing

- On the Edit Other IDs page, select the Plus Sign (+) icon to add a new row and enter the following information.

- Other ID Type. Select Organization for Billing from the drop-down menu.

- Organization. Select the Employee’s primary Company.

- Description. Enter if needed.

- Identification #. This should be in the following format: M_01222333. Use these guidelines:

- M = Workstation

- 01 = Adloc

- 222333 = Department number

- Issued Date. Enter the retirement date.

- Expiration Date. Leave blank.

Retiree Percent Local

- On the Edit Other IDs page, select the Plus Sign (+) icon to add a new row and enter the following information.

- Other ID Type. Select Retiree Percent Local from the drop-down menu.

- Organization. Select the Employee’s primary Company.

- Description. Enter if needed.

- Identification #. Enter the amount that represents the portion of the SGIP paid from local funds versus state funds. Use whole numbers without a “%” sign (e.g., 75% would be entered as “75”).

- Issued Date. Enter the Retirement Date.

- Expiration Date. Leave blank.

Retiree Retirement Program

- On the Edit Other IDs page, select the Plus Sign (+) icon to add a new row and enter the following information.

- Other ID Type. Select Retiree Retirement Program from the drop-down menu

- Organization. Select the Employee’s primary Company.

- Description. Enter if needed.

- Identification #. Enter T, O or E, using the following guidelines:

- T = TRS

- O = ORP

- E = ERS

- Issued Date. Enter the Retirement Date.

- Expiration Date. Leave blank.

- Enter any comments, if needed.

- Select Submit at the bottom of the page.

- Return to the To Do Update Retirement Other IDs in your Inbox and select Submit.

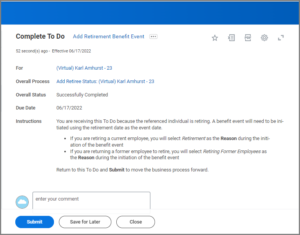

To Do: Add Retirement Benefit Event

The Benefits Partner will receive a To Do step to create a Retirement Benefit Event, using the retirement date as the event date.

Up Next

The business process will then route to the Retiree to change their benefits elections. The Retiree will also receive a notification to elect how they would prefer to receive retirement and insurance information from the A&M System via email. The Benefits Partner can make this election on behalf of the Retiree by referring to the job aid Update Retiree Electronic Communication (Benefits Partner).

This completes the Return to Retire process for a Worker already in Workday.