This job aid outlines the process for an HR Contact to request a one-time payment for an Employee. One-time payments can be used to issue ad hoc payments to an Employee for additional work, awards programs, or reimbursements. This will also be used to tax the Employee through an emolument.

Request One-Time Payment (TAMU)

This custom job aid is intended for TAMU, TAMUG, and TAMHSC.

Important Information

- One-time payments can be a single payment or set-up as multiple payments to pay employees for additional work.

- Be sure to check with the Budget Contact regarding budgetary concerns prior to initiating a one-time payment request.

- If the funding account is an 04 (Sponsored Research Funds), contact Sponsored Research for the appropriate approval prior to submitting.

- One-time payments must have a prior approval in writing from the appropriate level approver that will be attached to the business process. If the approval document has multiple employees listed, the HR Contact must redact any information related to another employee before submission.

- One-time payment requests must be completely approved before payroll calculations are run, refer to the Payroll Processing calendar.

- The date the Employee will be paid the one-time payment is displayed in the Organizational Assignments box after the Scheduled Payment Date has been entered.

Getting Started

Initiate a Single One-Time Payment

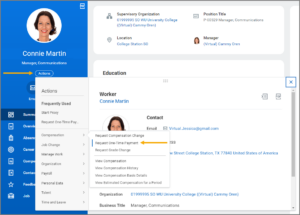

- Navigate to the Worker Profile of the Employee for whom you would like to request a one-time payment.

- Select Actions > Compensation > Request One-Time Payment.

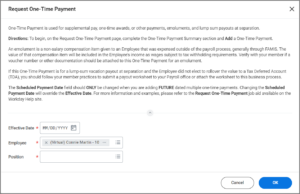

- In the Request One-Time Payment window, complete the following fields:

- Effective Date. Enter the date that falls within the pay period in which you would like the Employee to be paid.

Note: The Employee cannot receive the One-Time Payment prior to the services being completed.

Important: The Effective Date field determines the pay period in which the Employee will be paid. However, if the Effective Date occurs after pay calculations are initiated for the pay period, the payment will process in the following pay period.

- Select OK.

Note: You can only initiate a one-time payment request for Employees within Supervisory Organizations your security role supports. If you need to request a one-time payment for an Employee outside of Supervisory Organizations you support, contact the appropriate HR Contact who supports the Supervisory Organization to initiate the business process.

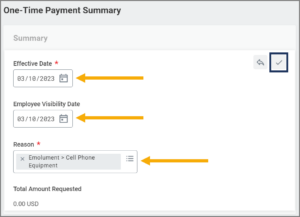

- The Request One-Time Payment page displays. Under One-Time Payment Summary, confirm the Effective Date and complete the following fields.

- Employee Visibility Date. Enter the date the Employee should see their pay-related one-time payment changes in Workday. If left blank, the Employee Visibility Date will default to the Effective Date. Selecting a different Employee Visibility Date will allow Managers time to inform their Employees in person.

- Reason. Enter the reason for the one-time payment.

- One Time Payment > Emolument. An Emolument is only used to tax the Employee when they receive cash awards, gifts, non-qualified moving expense (relocation allowance not grossed up and paid through AggieBuy), 90-day reimbursement, etc. This does not pay the Employee.

- One Time Payment > Incentive. An Incentive is used to pay for an established and approved award program. Use Incentive > Award, not Performance.

- One Time Payment > Merit. A Merit Salary One-Time Payment Increase is a lump sum payment granted to an Employee in recognition of meritorious job performance. Merit > Merit Payment – Outside the Budget Cycle will be used for any merit requests not to be effective on 09/01. Merit > Merit Payment – Regular Budget Cycle will be used for any merit requests effective on 09/01.

- One Time Payment > Supplemental. This is used for all other additional compensation given to the Employee. The only category TAMU (M, H, G) uses is Supplemental > Extra Pay for Single Activity.

- Select the Check Mark button to save changes. The HR Contact will be able to update the Total Amount Requested in the following section.

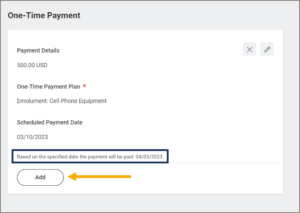

- In the One-Time Payment section, select the Add button.

- Select the appropriate One-Time Payment Plan.

- Additional fields will display. (Some will be auto-populated.)

- Amount. The amount of the one-type payment (in the currency selected underneath).

- Currency. This may be auto-populated. This will be in U.S. dollars.

- Scheduled Payment Date. IMPORTANT! Do not adjust the Scheduled Payment Date. This field is only applicable when making multiple one-time payments. The Scheduled Payment Date does not represent the date the Employee will be paid. The date the Employee will be paid appears under the Schedule Payment Date. The Scheduled Payment Date field will override the Effective Date you first selected and may push the one-time payment into the next payroll period.

- Send to Payroll. Do not uncheck the checkbox.

- Additional Information. Provide relevant information regarding the one-time payment for the Manager, Department Head and Executive Approver.

Note: The HR Contact will add HR-specific details, which may include a comment template, in the comment box.

- Select the Check Mark button to save changes.

Note: This process does not route based on a Worktag like the Assign Costing Allocations business process. Any approvals to use a specific account must be obtained outside of Workday. To see payment guidelines, select Supporting Information; the fields in this section may not be editable.

If you have no additional one-time payments to request, skip to Step 15.

Initiate Multiple One-Time Payments

If you have multiple one-time payments to process for the Employee, you can do so within the same business process. After completing the steps above for initiating a one-time payment, continue as follows:

- Select the Add button below the One-Time Payment section.

- Select the appropriate One-Time Payment Plan.

- Additional fields will display. Complete these fields in the same way as in Step 9 (including Worktags) except for:

- Scheduled Payment Date: Enter the effective date for this additional one-time payment. Remember, this is not the date the Employee will be paid. The Employee will be paid on the next payroll if the Scheduled Payment Date is within the pay period of that date before payroll calculations are run. This date is now provided under the Scheduled Payment Date.

- Scheduled Payment Date: Enter the effective date for this additional one-time payment. Remember, this is not the date the Employee will be paid. The Employee will be paid on the next payroll if the Scheduled Payment Date is within the pay period of that date before payroll calculations are run. This date is now provided under the Scheduled Payment Date.

- Select the Check Mark button to save changes.

- Enter any comments as needed. The HR Contact will add HR-specific details, which may entail a comment template, in the comment box.

- Select Submit.

Up Next

The request will be routed to the Compensation Partner for review/approval. After it has been approved, the Manager will receive the task to approve. Then the Department Head and Executive Approver (only if Merit is selected as the reason) will approve to complete the business process.

For Faculty positions, the request will only route through the Compensation Partner. However, if merit was selected as the reason, after approval from the Compensation Partner it will also route to the Manager, Department Head, and Executive Approver.

This completes the Request One-Time Payment business process.