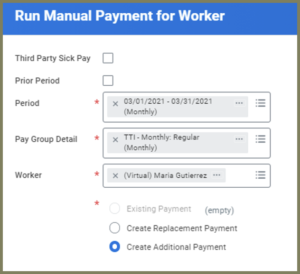

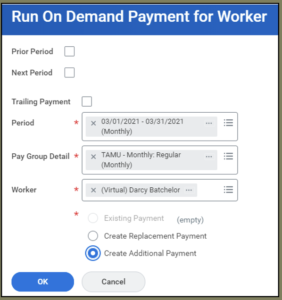

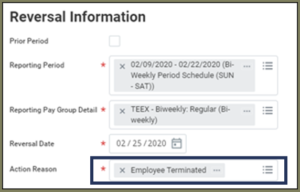

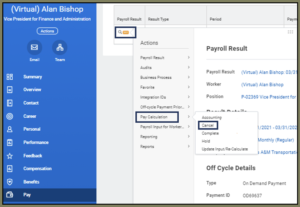

Off-cycle payments are payments processed in Workday outside of the regularly scheduled, on-cycle pay run for the Worker.

The purpose of this guide is to provide an overview of the various types of off-cycle payments that are possible in Workday and the process used to complete those payments.