This job aid outlines the process for a Payroll Partner to enter and manage tax treaties for an Employee.

Maintain Worker Tax Treaties

Page Loading...Checking SSO..

Important Information

While maintaining an Employee’s tax treaties, you must enter information including tax year, tax residency country, income code, income code subtype, treaty benefit start date, and treaty benefit end date.

Getting Started

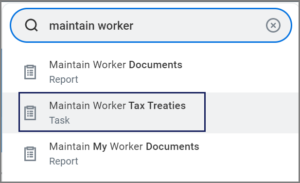

- Search for and select the Maintain Worker Tax Treaties task using the Search Bar.

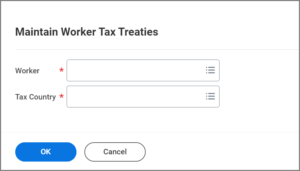

- On the Maintain Worker Tax Treaties page, enter the Employee’s name in the Worker field and select the country in the Tax Country field.

- Select OK.

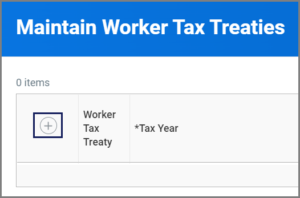

- If there are no treaties currently listed, select the Plus Sign (+) icon to add a new tax treaty.

- Complete the following fields: Tax Year, Tax Residency Country, Income Code, Income Code Subtype (if applicable), Treaty Benefit Start Date, and Treaty Benefit End Date.

Note: In the Income Code Subtype field, do not select Income Code of 16. TAMUS does not pay scholarships or fellowships via payroll.

- Enter any additional information, as needed.

- If needed, select the Plus Sign (+) icon and repeat step 5 to add additional tax treaties.

- Select OK.

This completes the Maintain Worker Tax Treaties process.