This job aid details activities for a Payroll Partner to identify emoluments on the current payroll when the Employee is not being paid.

Identifying Emoluments When Employee Is Not Paid

Page Loading...Checking SSO..

Important Information

- An Employee who receives an emolument must pay OASDI and Medicare taxes on the amount of the emolument even if the Employee is not receiving pay.

- This scenario typically happens when a terminated Employee has an emolument that needs to be processed through payroll or for an Employee who does not receive pay during the summer months and is receiving an emolument. The OASDI and Medicare tax amount will be placed in arrears which causes issues for tax reporting because the tax has not been paid or collected from the Employee.

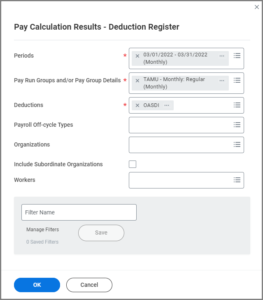

- Payroll Partners should run the Workday report Pay Calculation Results – Deduction Register to identify emoluments on the current payroll.

Getting Started

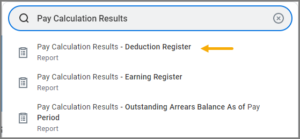

- Search for and select the Pay Calculation Results – Deduction Register report in the Search Bar.

- Enter data in the three required fields.

- Select OK.

- Review the results.

Note: Actions taken to resolve gross-up payments are based on your Workstation’s business rules.Important: If a column titled Current Period Arrears is returned and shows results, you have an Employee with an issue for tax reporting. The emolument causing the problem should be removed and reapplied later when the Employee is actually paid or grossed-up if the Employee has terminated or retired.

Note: Actions taken to resolve gross-up payments are based on your Workstation’s business rules.Important: If a column titled Current Period Arrears is returned and shows results, you have an Employee with an issue for tax reporting. The emolument causing the problem should be removed and reapplied later when the Employee is actually paid or grossed-up if the Employee has terminated or retired.

This completes the Identifying Emoluments When Employee is Not Paid process.