This job aid outlines the steps for an Employee to edit their Federal Tax Election Form W-4 in Workday.

Edit Your W-4

Page Loading...Checking SSO..

Prerequisites

- The IRS W-4 Form and instructions can be found on the irs.gov home page under Forms and Instructions.

- If you are a Nonresident Alien (a person who is not a United States Citizen), refer to Notice 1392, Supplemental Form W-4 instructions for Nonresident Aliens before completing your W-4 in Workday. You can search for Notice 1392 on irs.gov.

- All active employees should have a W-4 in Workday.

Getting Started

- Select the Pay application.

- Under Actions, select Withholding Elections.

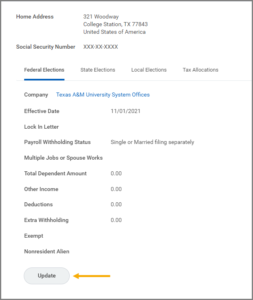

- Select Update.

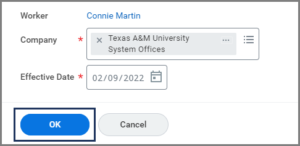

- Confirm your Company and Effective Date, then select OK.

IMPORTANT: Any changes you submit will take effect on your next pay date, provided payroll for that pay date has not already been processed.

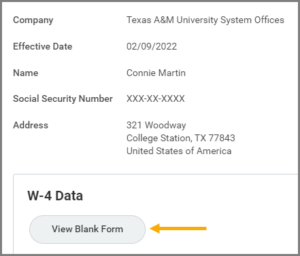

- If you want to obtain a blank copy of the IRS Form W-4, select View Blank Form under W-4 Data.

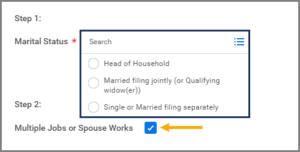

- Select your Marital Status from the options provided:

- Head of Household. Select this only if you are unmarried and pay more than half the costs of keeping up a home for yourself and a qualifying individual.

- Married filing jointly (or Qualifying widow(er)). Select this if you are married and will be filing with your spouse on the same tax return or if you have been widowed for two years or less and have a dependent child.

- Single or Married filing separately. Select this if you are single or if you and your spouse will be filing separate tax returns.

- Check the Multiple Jobs or Spouse Works box if you hold more than one job at a time or you are married filing jointly and your spouse also works.

Note: The correct amount of withholding depends on income earned from all jobs.

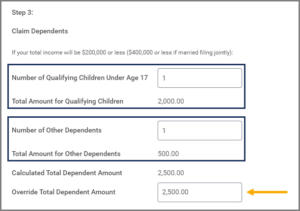

- In the Claim Dependents section, enter the following information as needed:

- Number of Qualifying Children Under Age 17. The number you enter here is multiplied by 2,000.00 to automatically populate the field Total Amount for Qualifying Children.

- Number of Other Dependents. The number you enter here is multiplied by 500.00 to automatically populate the field Total Amount for Other Dependents. The Calculated Total Dependent Amount will then reflect the sum of the Total Amount for Qualifying Children and the Total Amount for Other Dependents.

- Override Total Dependent Amount. Enter an amount if you want to change the Calculated Total Dependent Amount.

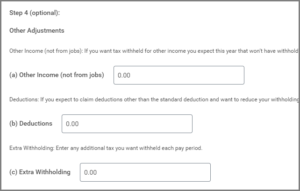

- Under Other Adjustments (which is optional), enter the following information as needed:

- Other Income (not from jobs). Enter an amount if you want tax withheld for other income you expect this year that will not have a withholding. This may include interest, dividends and retirement income.

- Deductions. If you expect to claim deductions other than the standard deduction and want to reduce your withholdings, use the worksheet on page 3 of the instructions for completing the IRS Form W-4 2020 and enter the result here.

- Extra Withholding. Enter any additional taxes you want withheld each pay period.

- Check the Exempt checkbox if you had no federal income tax liability in the previous year and you expect to have no federal income tax liability in the current year. By checking the Exempt checkbox, no federal income tax will be withheld.

- Check the Nonresident Alien checkbox if you are a nonresident alien.

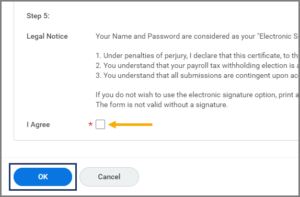

- Check the I Agree checkbox and select OK.

This completes the Edit Your W-4 process.