This job aid details the steps for a Benefits Partner to update Benefits Annual Rates (BARs) for an Employee, former Employee returning to retire, or a Retiree.

Update Benefits Annual Rates (BARs) for an Employee (Benefits Partner)

Last updated on June 6, 2024

Page Loading...Checking SSO..

Important Information

- The use of the term Employee can be interchanged with Retiree for this job aid.

- You should complete this task before initiating a Retirement Benefit Event.

- Workday will automatically calculate the BARs for Employees during the Hire Benefit Event or Job Change Benefit Event.

- Workday Services will update the BARs for existing Employees after Open Enrollment is completed in August of each year.

- Run the BAR (Benefit Annual Rate) Audit Report in Workday if there is an issue in setting the BARs during a staffing event, and you need help calculating the amount or if you want to audit your Employee population to ensure BARs were set correctly.

Getting Started

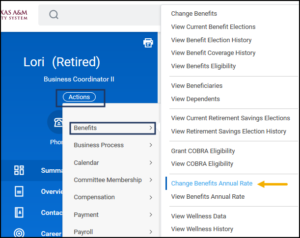

- Navigate to the Employee’s Worker Profile and select Actions > Benefits > Change Benefits Annual Rate.

- Enter the Effective Date.

Note: The Effective Date should be 9/1 of the current plan year for an Employee/existing Retiree or the Retirement date for a former Employee returning to retire.

Note: The Effective Date should be 9/1 of the current plan year for an Employee/existing Retiree or the Retirement date for a former Employee returning to retire. - Select OK.

- Edit an existing row or select the Plus (+) icon to add a new row.

- Enter the following information:

- Benefits Annual Rate Type. Select one from the list. You will need to select Retiree Alternate Basic Life for retirees who certify others.

- Currency. Select USD.

- Benefits Annual Rate. Enter the rate amount. The maximum allowed rate for a retiree ABL is $50,000.

- Select OK and Done.

- Initiate the Retirement Benefit event for a former Employee returning to retire. Refer to the Add Retire Status or Return to Retire job aids for help on initiating the Retirement Benefit Even.

This completes the Updating Benefits Annual Rates task.